Habil F Khorakiwala, Chairman,

Wockhardt says the company will use the proceeds of the recent qualified institutional placement (QIP) to pare debt of

₹100-110 crore and to conduct phase three clinical trials for a new antibiotic, WCK 5222.

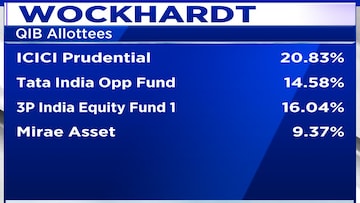

Funds managed by veteran investors Madhusudan Kela and Prashant Jain are among the institutions that

invested in the QIP. The drugmaker approved the closure of the institutional share sale on March 26, raising ₹480 crore.

As part of the placement, Wockhardt issued 92.85 lakh equity shares at an issue price of ₹517 per share, representing a 5% discount to the QIP floor price of ₹544.02 per share.

Khorakiwala said the clinical trial for WCK 5222 is expected to be completed by next year. The company will file for approval in other markets. “We expect the approval to come sometime in early 2026,” he said.

The earnings before interest, taxes, depreciation and amortisation showed a staggering 80% year-on-year (YoY) growth to ₹173 crore in the period under review.

Wockhardt's growth trajectory in the last three years has been led by vaccines and novel drug discovery of WCK 5222, Nafithromycin, and Emrok. Demands for diabetes biosimilars for India and emerging markets also contributed to the company's consolidated position in the market.

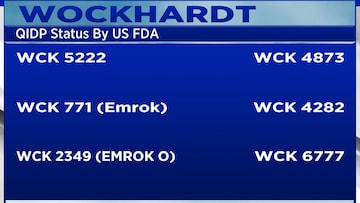

A total of six programmes of Wockhardt have received Qualified Infectious Disease Product (QIDP) status from the United States Food and Drug Administration (USFDA). These are eligible for a fast-track development process and priority review.

The current market capitalisation of the company is ₹8,951.33 crore.

For more, watch the accompanying video

(Edited by : Shweta Mungre)