Vodafone Idea may raise part of the ₹20,000 crore by selling fresh equity shares to the public. The remaining amount may come from the promoter Aditya Birla Group, which would get preference shares in return, sources with direct knowledge of the fundraising exercise at the Mumbai-based telco told CNBC-TV18.

Shares of Vodafone Idea fell over 11% as of 12:24 pm on February 28, a day after the company's board approved the proposal to raise funds.

In theory, a follow-on public offering (FPO) i.e. the sale of fresh shares by a listed company, increases the supply of shares thereby bringing down the value of existing shares.

Will investors be interested in a Vodafone Idea FPO?

The management hopes that the fund infusion by the promoter and the possibility of a tariff hike later in the year would give investors the confidence to bet on the FPO.

CNBC-TV18 reached out to Vi as well as Aditya Birla Group to confirm the FPO plan but did not get a response.

How much money does Vodafone Idea need?

On February 27, the Vodafone Idea board approved a ₹20,000-crore fundraising plan, which will be put to the shareholders for approval in an extraordinary general meeting (EGM) on April 2.

The equity investments will allow the telco to raise another ₹25,000 crore in debt, taking the total to ₹45,000 crore, which the company aims to conclude by June 2024.

The money will be critical for Vodafone Idea to expand its 4G coverage and roll out its 5G network. It's already lagging behind peers Reliance Jio and Bharti Airtel in its transition to the next generation of mobile telephony.

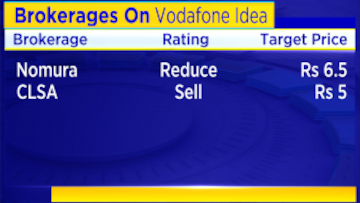

While the much-awaited fund infusion seems closer than before, analysts on the street are still sceptical about the company's prospects.

The company has been speaking about the impending fundraiser for nearly two years but the process hasn't moved much beyond that.

Kumar Mangalam Birla's telco is currently saddled with a debt of over ₹2.4 lakh crore after losing over 13 million subscribers between April and December 2023, and 15 straight quarters of mounting losses.

(Edited by : Sriram Iyer)

First Published: Feb 28, 2024 10:53 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM