Raghu Tangirala, Chairman and Managing Director of Chennai-based Updater Services is confident that the company's integrated facilities management (IFM) business will grow in the 18-25% range in the coming financial year.

IFM, accounting for about 65% of Updater Services' revenue, encompasses a range of services including the maintenance of infrastructure facilities end-to-end, and has earnings before interest, tax, depreciation, and amortisation (EBITDA) margins of around 5%.

Around 35% of the IFM business comes from the manufacturing segment, Tangirala said.

The company hopes to end FY24 at ₹2,450 crore and FY25 at ₹2,900 crore of revenue.

The BSS segment, though smaller at 35% of the company's revenue, has higher margins of around 13% to 15%. This segment includes sales enablement for major clients, involving strategy planning, market targeting, lead generation, and sales execution.

Through the IPO proceeds, the company has repaid debt to the tune of ₹1,330 million in October 2023. This will lead to a reduction in finance costs going ahead.

Around ₹80 crore of the IPO proceeds were marked for mergers and acquisitions (M&A). “We hope to do something in the next two quarters in the BSS segment. Anywhere between ₹80 crore and ₹150 crore is what we are looking at (as an amount earmarked for this acquisition),” Tangirala said.

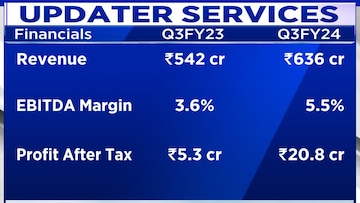

In October-December 2023, Updater Services' revenue grew 17% to ₹636 crore while profit after tax (PAT) surged 293% to ₹21 crore.

For more, watch the accompanying video