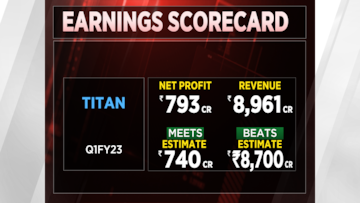

Titan is focused on brand building, investments and digital, its management told CNBC-TV18, after the Tata group maker of watches, jewellery and eyewear surprised the Street with a 13-times jump in net profit boosted by an all-round performance.

“We are now not further pushing our pedal on cost cutting. Rather the whole focus is on investment, in brand building, talent, digital and retail expansion. The cost program, which was there and got imbibed into the system, is sustaining but right now, the focus is on growth and getting new customers,” said Titan CFO Ashok Sonthalia.

Titan — whose brands include Tanishq, CaratLane, Fastrack and Titan EyePlus — said its profitability was driven by its jewellery business thanks to festive demand and stable gold rates.

Titan's revenue from its jewellery unit nearly tripled to Rs 7,956 crore for the April-June period, from Rs 2,891 crore for the corresponding quarter a year ago, according to a regulatory filing.

The EBIT margin of the unit — a measure of a business's operating efficiency — increased by 570 basis points on a year-on-year basis to 12.9 percent.

The company's overall EBITDA margin — a key measure of operating profitability — improved by 860 basis points to 13 percent, as against the estimate of 12.4 percent by analysts polled by CNBC-TV18.

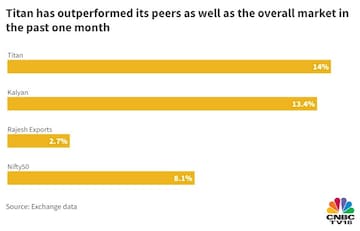

Titan's performance comes at a time when business across sectors are scrambling against an environment where high input costs are eating into their margin.

Titan did not give a margin guidance for the year ending March 2023. “We will not put a number for this year, but we have already talked about almost 2.5 times for the company in five years. This translates to roughly 20 percent. It may not happen every year, but the five-year horizon is 2.5,” said Sonthalia.

Both of Titan's watches and eye care units, which have high operating leverage, saw their highest quarterly revenue, he pointed out.

"Once they grow, their profitability improves quite significantly. For watches, maintaining a 12-14 percent EBIT will not be difficult," he added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Father and son reside on same street but vote for Andhra Pradesh and Telangana separately

May 7, 2024 4:40 PM

Lok Sabha elections 2024: Radhika Khera, Shekhar Suman join BJP; meet all who are now in saffron party

May 7, 2024 3:54 PM

2024 Lok Sabha Elections | Why phase-3 is a tightrope walk for all parties

May 7, 2024 1:08 PM