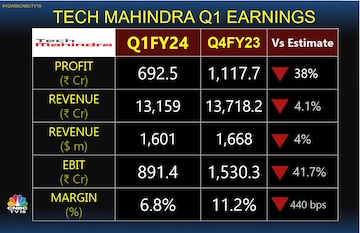

Tech Mahindra reported its first quarter results on July 26 and it misses Street estimates on all fronts. The revenues are 4.1 percent lower quarter on quarter at Rs 13,159 crore versus Rs 13,718 crore in March 2023 ended quarter.

The earnings before interest and tax (EBIT) is 42 percent lower sequentially at Rs 891 crore versus Rs 1,530 crore in March 2023 quarter. The EBIT margin has shrunk to 6.8 percent versus 11.2 percent sequentially.

The revenue in US Dollar terms declined 4 percent to $1,601 million from $1,668 million quarter on quarter. The constant currency revenue decline of 4.2 percent quarter on quarter is much higher than the

Street estimates of 1.8 to 2 percent.

The total headcount is down 4,103 on quarter on quarter basis to 1,48,297. On the positive side, the attrition eases to 13 percent in Q1FY24 versus 15 percent in Q4FY23 and 22 percent in Q1FY23.

The revenue share from Communications, Media and Entertainment (CME) industry is now lower at 37.8 percent compared with 40.4 percent year in Q1FY23. The manufacturing industry vertical contributes 16.9 percent to total revenues versus 15.3 percent in Q1FY23. The share of technology vertical increased to 10.7 percent from 9.7 percent, while BFSI industry vertical revenue share is lower at 16.1 percent versus 16.7 percent. The retail, transport and logistics revenue share is flat at 7.9 percent.

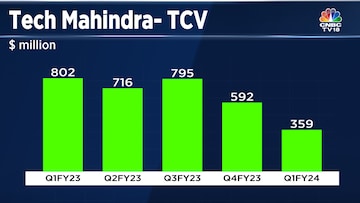

The total contract value is now at $359 million versus $592 million in the March 2023 ended quarter.

The revenues from three industry verticals, namely CME, BFSI and retail, transport and logistics declined by 8.2 percent, 5.4 percent and 2 percent respectively year on year. The manufacturing, technology and others verticals revenues grew in the range of 3 to 8 percent year on year.

The company says, this quarter was challenging due to strong headwinds, which impacted the revenue growth and profitability. The stock closed the trading session on July 26 with a decline of 1.1 percent.

First Published: Jul 26, 2023 4:00 PM IST