Tata Motors Limited (

TML) on Monday, March 4, announced that its Board of Directors has given the green light to the demerger of the company into two separate entities. This strategic decision aims to segregate the Commercial Vehicles (CV) business and its related investments into one listed company, while the Passenger Vehicles (PV) businesses, including PV, Electric Vehicles (EV), Jaguar Land Rover (JLR), and their associated investments, will form another listed company.

The demerger, set to be implemented through a National Company Law Tribunal (NCLT) scheme of arrangement, ensures that all existing shareholders of TML will maintain identical shareholding in both listed entities, it informed in a press release. This development follows the successful independent operation of the CV, PV+EV, and JLR businesses under their respective CEOs since 2021, marking a strategic shift for Tata Motors.

"Over the past few years, the Commercial Vehicles (CV), Passenger Vehicles (PV+EV), and

Jaguar Land Rover (JLR) businesses of Tata Motors have delivered a strong performance by successfully implementing distinct strategies. Since 2021, these businesses have been operating independently under their respective CEOs," the company said.

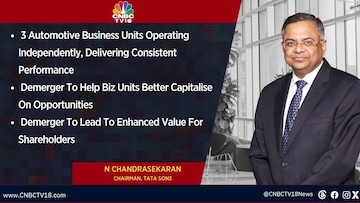

N Chandrasekaran, Chairman of Tata Motors, commented on the demerger, stating, “Tata Motors has scripted a strong turnaround in the last few years. The three automotive business units are now operating independently and delivering consistent performance. This demerger will help them better capitalise on the opportunities provided by the market by enhancing their focus and agility.” Market expert Prakash Diwan stated, “The commercial vehicles industry is still trying to reset. The passenger car segment is growing much faster. It was spoken about two years back. They now know that the PV segment is ready to gallop.” Out of the 34 analysts tracking Tata Motors, 26 recommend a "buy," five suggest "hold," and three give it a "sell" rating. The stock is currently trading above its 12-month consensus price target of ₹951.22.

The shares hit a fresh 52-week high of ₹995 apiece in the session today.

First Published: Mar 4, 2024 4:38 PM IST