Sona BLW Precision Forgings is poised for a turnaround in its biggest market, North America, as the

United Auto Workers (UAW) strike in the United States, which commenced on September 15, 2023, approaches its conclusion. Vivek Vikram Singh, MD and Group CEO of Sona Comstar, said the strike is in its "end game" and that the North American market is expected to rebound in the coming weeks.

“North America had some temporary issues with the strike against the big three

original equipment manufacturers (OEMs). Today I woke up to the news that that

strike is in its end game, hopefully in this week or next week we should see the end of that strike. So, America will also pick up now,” he told CNBC-TV18 during an exclusive chat.

The strike, which has impacted several plants of three major OEMs, Ford, General Motors, and Stellantis, has indirectly affected Sona Comstar as a supplier to these OEMs. Approximately 13,000 UAW workers are participating in the "Stand Up Strike" to advocate for their demands.

In response to this development, shares of Sona BLW Precision dropped by up to 2% to an intra-day low of ₹587.10 per piece on BSE on October 18, 2023.

Over the last month, there has been a decrease of more than 8% in share values.

In its FY23 annual report, the company revealed that 71% of its revenues are derived from global markets outside India, with key regions being North America (43%), Europe (20%), India (29%), and Asia (excluding India) (7%).

Source: Sona Comstar Annual Report 2022-23

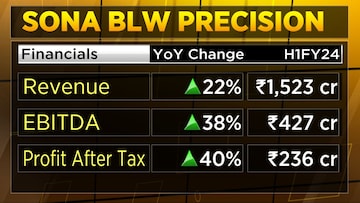

Singh also shared his belief that achieving a 30% growth rate in the near future is attainable, thanks to a substantial order book. Over the past 22 years, Sona BLW has maintained an impressive 30% compound annual growth rate (CAGR), and Singh expressed confidence in sustaining this growth rate in the coming years.

“At least for the next 3-4 years, this 25-30% growth is fairly doable. We know that because of our order book,” he stated.

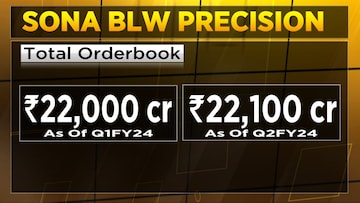

The company's strong focus on electric vehicles (EVs) is evident in its order book, with EV programmes contributing a significant 78% to the total order book, which stands at ₹22,100 crore as of September 30, 2023. Sona BLW's EV revenue reached a record high of ₹207 crore, with a particular emphasis on the EV differential segment.

In the electric two-wheeler and three-wheeler markets, the company is one of the largest players in India. Furthermore, the introduction of the Intelligence Suspension Motor in two years is expected to further enhance the company's product portfolio.

Sona BLW's promising outlook has garnered attention from leading financial institutions. JPMorgan upgraded the stock to "Neutral" with a target price of ₹475, while CLSA upgraded it to "Outperform" with a target price of ₹578. Jefferies, too, issued a "Buy" rating with a target price of ₹700.

As of October 26, 2023, shares of Sona BLW Precision Forgings have rallied, surging by more than 4% to reach ₹537.30 per piece on BSE.

For more details, watch the accompanying video

Source: Sona Comstar Annual Report 2022-23

Source: Sona Comstar Annual Report 2022-23