By Yoosef K | Sonal Bhutra Oct 4, 2022 3:25:19 PM IST (Published)

Listen to the Article(6 Minutes)

With the rupee marching towards 82 per dollar for the first time, Indian companies with higher exposure to foreign currency loans will likely see their finance cost surging in the coming quarters.

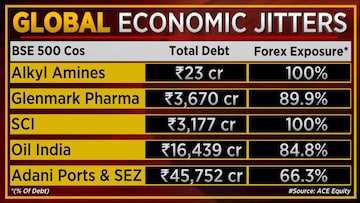

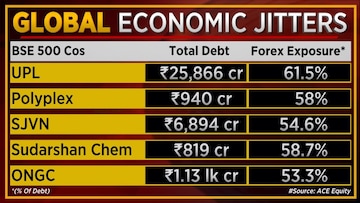

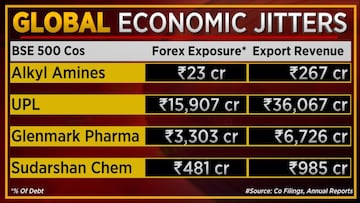

As many as 71 companies (excluding banks and financials) from the BSE500 index had a combined foreign currency exposure to the tune of Rs 3.5 lakh crore at the end of FY22.

While the aggregate borrowings by these 71 companies stood at Rs 15.2 lakh crore as of March 2022, foreign currency loans accounted for 23 percent of their total borrowings, data sourced from Ace Equity showed.

For instance, the gross debt of Glenmark Pharmaceuticals increased by 2.6 percent in the first quarter of FY23 to Rs 3,765 crore, as the rupee lost 4.6 percent during the quarter. Nearly 90 percent of Glenmark’s loans are in foreign currency.

“During this quarter also, the rupee moved substantially. So, that is mainly the reason why there is an upward movement in debt," V. S. Mani, CFO and Executive Director of Glenmark, said after the first quarter results. Also, we had refinanced FCCBs, he said.

According to Bloomberg, nearly $11 billion worth of foreign currency notes will mature over the next year. While bonds worth $500 million each are maturing in October for NTPC and BPCL, next year would see bonds of similar values getting matured for Vedanta Resources, IOCL and ONGC Videsh.

Moreover, a greater impact due to currency depreciation would mostly see in those firms where the base currency is the US dollar. Even as the rupee has depreciated 9 percent against the US dollar between January and now, the local currency has gained 9.2 percent against the British pound and 5 percent over euro during the same period. Further, the hedging strategy placed in by each firm will also have a bearing on their interest outgo.

| Currency | Price | Change | %Change |

|---|