RPG Life Sciences, a prominent integrated pharmaceutical company, is looking for prospective merger and acquisition (M&A) partners, according to Yugal Sikri, the company's Managing Director.

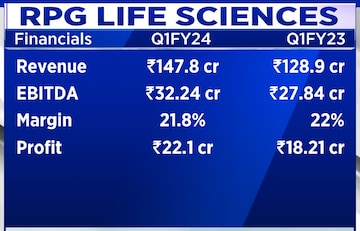

In an exclusive interview with CNBC-TV18, Sikri highlighted the company's burgeoning cash surplus and its strategic intent to employ these resources for business expansion, making M&A an imminent priority. With a well-defined acquisition strategy in place, RPG Life Sciences is actively seeking the right candidate to bolster its growth trajectory.

"We have the cash surplus and cash surplus is increasing quarter after quarter. And this cash surplus is intended to be used in business growth, and M&A is very much on our horizon. It's just that we need to get the right candidate. We have defined clearly our acquisition strategy," stated Sikri during the interview.

RPG Life Sciences has meticulously planned and analyzed its pursuit of optimal M&A opportunities. The company has pinpointed specific therapy areas, branded products, and target customer segments in its strategy.

Thorough due diligence is being conducted to ensure that, when the right candidate emerges, the company can navigate the often volatile valuations without disrupting its established five-year trajectory of enhancing EBITDA margins. Despite this caution, M&A remains a prominent aspect of the company's future plans, actively pursued as previously mentioned.

Sikri also discussed the company's impressive performance in the pharmaceutical market, particularly highlighting the success of the painkiller brand Naprosyn.

"Naprosyn, a painkiller brand which was Rs 18 crore four years back now, it has crossed Rs 60 crore last year. And the next target is Rs 100 crore, and I expect Rs 100 crore to be achieved in the next couple of years max. For that, we have a very clearly defined lifecycle management strategy in place, which is what we are following," Sikri added.

The stock ended at Rs 1,242 on the NSE, up by 1.69 percent. It has gained over 6.46 percent in the last one month.