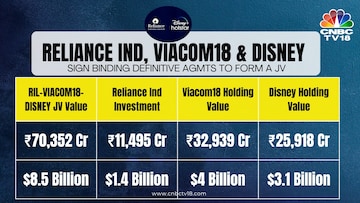

Reliance Industries Ltd (RIL) has driven a hard bargain to clinch a mega-deal in the entertainment space—a deal that values The Walt Disney Company’s India business at around $3 billion against earlier estimates of up to $15 billion. It would also lead to a ₹70,000 crore, Reliance-controlled joint venture (JV) that combines the media businesses of Viacom 18 and Star India. Reliance will also invest ₹11,500 crore in the venture to fuel its growth strategy.

RIL's own 16.34% stake and a 46.82% stake through its unit, Viacom18, give billionaire Mukesh Ambani-promoted oil-to-retail-to-telecom conglomerate the majority controlling stake at 63.16% in the merged entity. Disney has a 36.84% stake in the merged entity.

Disney, in its disclosure to the NYSE, has said that it "expects to record non-cash pre-tax impairment charges estimated to be between $1.8 billion to $2.4 billion, approximately half of which reflects a write-down of the net assets of Star India... and approximately half of which reflects a write-down of goodwill at the entertainment linear networks reporting unit, reflecting the impact of removing Star India."

The company will continue to adjust the net book value of Star India to its fair value until the closing date of the transaction.

Nita Ambani to head the merged entity

Nita Ambani will be the Chairperson of the merged entity, with Uday Shankar acting as Vice Chairperson providing strategic guidance to the JV. Shankar is a former top Disney executive and has a JV with James Murdoch, called Bodhi Tree.

RIL Chairman and Managing Director Mukesh Ambani called the JV "a landmark agreement that heralds a new era in the Indian entertainment industry."

Bob Iger, CEO of The Walt Disney Company said, “India is the world’s most populous market, and we are excited for the opportunities that this joint venture will provide to create long-term value for the company."

The JV will also be granted exclusive rights to distribute Disney films and productions in India, with a license to more than 30,000 Disney content assets, providing a full suite of entertainment options for the Indian consumer.

"Reliance has a deep understanding of the Indian market and consumer, and together we will create one of the country’s leading media companies, allowing us to better serve consumers with a broad portfolio of digital services and entertainment and sports content,” Iger added.

Uday Shankar said, “We are privileged to be enhancing our relationship with Reliance to now also include Disney, a global leader in media and entertainment. All of us are committed to delivering exceptional value to our audiences, advertisers, and partners. This joint venture is poised to shape the future of entertainment in India and accelerate the Hon’ble Prime Minister’s vision of making Digital India a global exemplar.”

The transaction is subject to regulatory, shareholder and other customary approvals and is expected to be completed in the last quarter of calendar year 2024 or the first quarter of 2025.

According to

Raj Nayak, Founder and Managing Director at House of Cheer, it is a great marriage that has happened. “Strategically it makes a lot of sense for them because there is so much of synergies that they will be able to bring it. If they merge both the entities, which is Disney Hotstar, Jio Cinema, Voot, Hulu – if they bring all of them together, they will be the leader in the content streaming place outside of Google and Meta. There is a huge opportunity for them to go international as well,” he said.

Reliance Industries share price settled nearly 2% lower on Wednesday, quoting at ₹2,915. So far this year, the RIL stock price has gained over 12%.

(Edited by : Arvind Sukumar)

First Published: Feb 28, 2024 7:02 PM IST