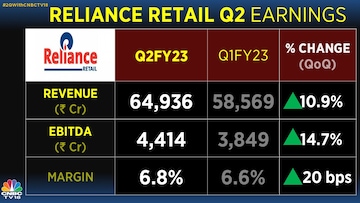

Reliance Retail reported record revenue for the September quarter that also surpassed brokerage estimates. The consumer retail arm of Reliance Industries Ltd. reported revenue of Rs 64,936 crore. On a year-on-year basis, revenue increased 11 percent.

The figure was higher than the Rs 62,140 crore that broking firm Nomura had projected.

Growth in the topline was led by a revival in footfalls, store additions and digital integrations.

During the September quarter, Reliance Retail opened 795 new stores, taking the total number of operational physical stores to 16,617. Footfalls stood in excess of 180 million, indicating a growth of 23 percent over the pre-COVID period.

As of date, the area of operation for Reliance Retail stands at 54.5 million square feet, compared to 37.3 million square feet during the same period last year.

On the operational front, the company's EBITDA increased 14.7 percent to Rs 4,414 crore, compared to Rs 3,849 crore in the June quarter and also higher than Nomura's estimate of Rs 4,230 crore.

EBITDA margin came in line with expectations of 6.8 percent.

Reliance Industries Chairman and Managing Director Mukesh D. Ambani said that the retail business continued to provide a compelling proposition of superior value across consumption baskets and price points.

Reliance Retail's digital commerce and new commerce business with daily orders grew 53 percent on a year-on-year basis.

Also Read: Reliance quarterly revenue up 5% in line with Street estimates as consumer-facing units shine

Market expert Prakash Diwan said there was no taking away from the fact that retail has outshone most expectations. Deven Choksey of KR Choksey Holdings also spoke of the consumer business showing resilience with good numbers compared to the oil-to-chemical (O2C) business.

However, Choksey said that he expected the retail business to deliver an earnings before interest, taxes, depreciation, and amortisation — EBITDA is a widely used measure of core corporate profitability — margin of 8 percent due to the addition of premium brands.

Ahead of results, shares of Reliance Industries had ended 1.22 percent lower on Friday at Rs 2,470.

First Published: Oct 21, 2022 7:54 PM IST

Note To Readers

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM