Ahmedabad-based Ratnamani Metals and Tubes, a manufacturer of seamless stainless steel and welded tubes and pipes is planing to set up an in-house stainless steel long products unit.

In an interaction with CNBC-TV18, the company's business unit head Manoj Sanghvi said that by backward integration of stainless steel long products, the company aims to strength its position in the industry.

"At the moment, there is no decision yet, but we are working on it." The proposed project is expected to involve a substantial capital expenditure ranging between ₹500 crore and ₹700 crore.

Until now, the company gets its stainless steel from third-party suppliers.

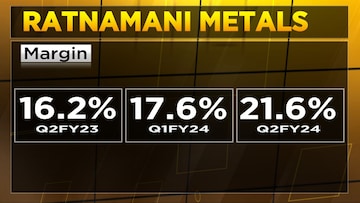

For the September quarter, Ratnamani Metals reported a revenue growth of 26% and Earnings before Interest, Tax, Depreciation and Amortisation (EBITDA) growth of 68% from last year. A key highlight of the quarter was the expansion in margins, which stood at over 21%, compared to the company's 16% to 18% guiidance.

A key reason behind the margin expansion was due to the higher percentage of stainless steel tube volumes and execution of good margin orders.

Sanghvi said that the company's topline for the end of the current financial year is likely to range between ₹4,800 crore - ₹5,000crore. The stainles steel business contributes 30% to the overall topline.

Sanghvi also provided insights into the company's future margin expectations, projecting a range of 16% to 18%. This guidance, while slightly lower than the margins achieved in the first half of financial year 2024, reflects considerations related to a higher contribution from the water pipe segment, which may impact overall margins.

The company's current capacity utilization stands close to 60%, showcasing room for further expansion.

Ratnamani's current order book as of November 1 stood at ₹2,950 crore, of which 20% comes from the exports market.

As of now, Ratnamani Metals & Tubes is trading at a fresh lifetime high, having rallied by 30% so far in 2023. The stock is currently trading at a price-to-earnings multiple of 35 times financial year 2025 estimated Earnings per Share (EPS).

With a market cap of Rs 24,375 crore the company appears poised for a dynamic phase of growth and innovation in the stainless steel industry.

For more, watch the accompanying video

First Published: Nov 20, 2023 3:06 PM IST