State-owned Punjab National Bank (PNB) on Thursday (August 31) raised the marginal cost of funds-based lending rate (MCLR) by 5 bps across tenures, effective from September 1, 2023.

The MCLR is the lowest interest rate at which a bank can make a loan to a customer.

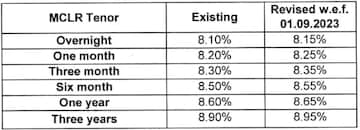

The bank has raised overnight MCLR by 5 bps from 8.10 percent to 8.15 percent. Meanwhile, one-month MCLR has been hiked from 8.20 percent to 8.25 percent, 3-month MCLR from 8.30 percent to 8.35 percent, and six-month MCLR from 8.50 percent to 8.55 percent.

Further, one-year MCLR has been raised from 8.60 percent to 8.65 percent and three-year MCLR from 8.90 percent to 8.95 percent, respectively.

Also Read: Now, customers of these five banks can scan UPI QR code and pay via digital rupee — Here's how

The bank reported a 477 percent rise in net profit at Rs 1,158.6 crore for the March quarter versus Rs 201.6 crore year-on-year. The net interest income (NII) surged 30 percent at Rs 9,498.7 crore versus Rs 7,304.1 crore year-on-year.

The gross non-performing assets (GNPAs) stood at 8.74 percent versus 9.76 percent quarter-on-quarter. The net NPAs for the fourth quarter rose by 2.72 percent versus 3.30 percent quarter-on-quarter.

In numbers, GNPAs came in at Rs 77,327.7 crore versus Rs 83,583.9 crore quarter-on-quarter and net NPAs stood at Rs 22,585 crore versus Rs 26,363.1 crore quarter-on-quarter.

Shares of Punjab National Bank ended at Rs 63.00, down by Rs 0.45, or 0.71 percent on the BSE.

(Edited by : Shoma Bhattacharjee)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!