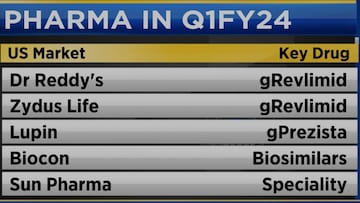

Pharmaceutical companies are anticipated to deliver stronger financial performance in the first quarter of the 2024 fiscal year. Analysts predict that the growth will primarily be driven by robust sales of key drugs, which will offset pricing pressures. In the United States market, some pharma companies could experience a significant year-on-year growth of around 10-12 percent during this quarter.

The domestic market is also expected to maintain its growth trajectory, fueled by price increases and enhanced sales volumes. It is estimated that the domestic market will achieve an average year-on-year growth rate of 10 percent.

Several pharmaceutical companies, including JB Chemicals, Eris Life, and Torrent, are likely to benefit from recent acquisitions such as Sanzyme, Oaknet, and Curatio, respectively.

Furthermore, these companies are expected to witness improved margins in Q1FY24. Sequentially, margins could increase by as much as 50 to 70 basis points, while year-on-year improvements could reach 3-4 percent for certain firms. The factors contributing to these margin improvements include sales of key drugs in the US market and reduced costs of raw materials and freight.

Regarding specific companies, analysts are closely monitoring Divis Labs and Laurus Labs in terms of their margins. Divis Labs is anticipated to achieve a quarter-on-quarter margin improvement of 300 basis points due to better gross margins.

However, Laurus Labs may continue to face margin pressure following a decline in margins in the previous quarter. Overall, API companies are expected to benefit from increased demand year-on-year.

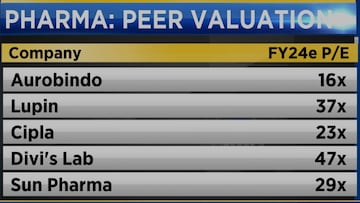

It is also important to keep an eye on key developments such as Lupin's launch of a generic version of Spiriva, Sun Pharma's progress in resolving the import alert at the Halol unit, and Aurobindo and Gland's outlook on injectable sales in the US.

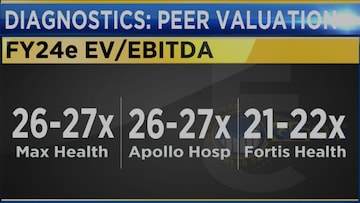

In the healthcare sector, hospitals are projected to achieve a year-on-year revenue growth of 12-13 percent, driven by an improved occupancy rate of up to 50-500 basis points. This increase in occupancy is expected due to the recovery of elective surgeries and a resurgence in international medical tourism.

Max Healthcare is likely to lead in terms of revenue and margin improvement, while Apollo Hospitals may experience lower profitability due to losses in its 24/7 arm.

For diagnostic companies, high single-digit volume growth in patient volumes is expected. Margins are predicted to stabilize quarter-on-quarter but remain under pressure year-on-year due to intense competition in the industry.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM