Vijay Shekhar Sharma, CEO of One97 Communications Ltd., known to operate digital payments provider Paytm Ltd., is looking to increase his stake in the company further, after becoming its largest shareholder.

"There is never a day that I would not buy more equity in Paytm," Sharma told Bloomberg News in an interview. Sharma is now Paytm's largest shareholder and Significant Beneficial Owner after acquiring a 10 percent stake from AntFin, thereby increasing his stake to 19.42 percent.

AntFin went on to sell another 3 percent stake in Paytm recently via block deals.

“The company is relentlessly focused on generating and earning every dollar it spends,” Sharma said in the interview.

Paytm was briefly India's biggest IPO, with shares of the near Rs 18,000 crore issue priced at Rs 2,150 apiece. However, the stock was not well received owing to valuations and fell nearly 80 percent from its issue price.

The stock has been on the mend since then but still remains significantly below its issue price. All analysts that track Paytm have a price target that is at least 50 percent below its IPO price.

Recently, Bernstein initiated coverage on the stock with an outperform rating and a price target of Rs 1,100. That day, the stock touched an 18-month high.

Bernstein's price target of Rs 1,100 is the third highest on the street for the stock. Ahead of Bernstein, Citi and Goldman Sachs have a price target of Rs 1,200 each, while Dolat Capital has a target of Rs 1,260.

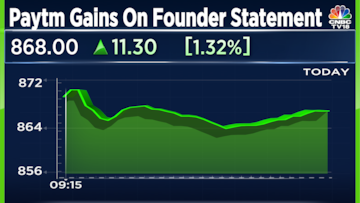

Shares of Paytm are down nearly 9 percent from their 52-week high of Rs 938 so far. The stock is currently trading 1.3 percent higher at Rs 868.

(With Inputs From Agencies.)

First Published: Sept 5, 2023 8:11 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM