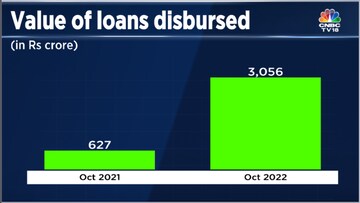

Paytm parent One97 Communications on Monday said that the value of loans disbursed grew 387 percent from the year-ago level to Rs 3,056 crore ($407 million). In comparison, the number of loans disbursed grew 161 percent to 3.4 million loans in October. Following the updates, Paytm shares jumped over 3 percent in early deals. At 10:12 am, the stock was trading 1.5 percent higher from the previous close at Rs 642.25 on BSE.

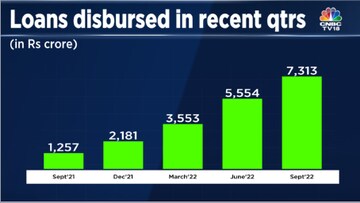

The digital payments firm said disbursements through its platform were at an annualised run rate of Rs 37,000 crore in October.

As loan disbursement grew manifold, founder and CEO Vijay Shekhar Sharma said, “We are on the right path to profitability and free cash flows. Our journey to build a scalable and profitable financial services business has just started.”

Paytm also said the firm had strengthened leadership in offline payments, with merchants paying subscriptions (for payment devices) exceeding 5.1 million.

“With our subscription as a service model, the strong adoption of devices drives higher payment volumes and subscription revenues while increasing the funnel for our merchant loan distribution,” it said in an exchange filing.

The total merchant Gross Merchandise Value (GMV_ processed through Paytm’s platform during the month aggregated to Rs 1.18 lakh crore ($14 billion), marking a y-o-y growth of 42 percent, partly due to the festive season, the company said.

It also reiterated that over the past few quarters, its focus has only been on volumes that generate profitability through net payments margin or direct upsell potential.

“We continue to drive user engagement, with the average MTU for October 2022 at 84 million, registering a growth of 33 percent Y-o-Y,” Paytm added.

Paytm’s loss for the September quarter of FY23 came in at Rs 571.5 crore, up from Rs 473.5 crore in the same period last year. This was lower than the CNBC-TV18 poll estimate of Rs 596 crore.

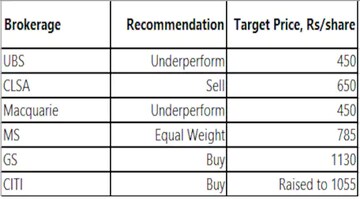

After the results last week, brokerages seemed divided, with some acknowledging the strong loan disbursement and GMV growth while others have expressed concerns over higher competition and weak unit economics.

First Published: Nov 14, 2022 9:16 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 8% voter turnout recorded by 9 am

Apr 26, 2024 9:11 AM