State-controlled Oil and Natural Gas Corporation (ONGC) on Monday (February 19) said the shareholders of its wholly-owned subsidiary Imperial Energy Ltd have approved the merger of five of its direct subsidiaries.

The subsidiaries — Imperial Energy Cyprus Ltd (IECL), Imperial Energy Nord Ltd (IENL), Redcliffe Holdings Ltd (RHL), Biancus Holding Ltd (BHL) and San Agio Investment Ltd (SAIL) — will be merged with Imperial Energy Ltd effective February 19, 2024.

This move is subject to the approval of the competent court of Cyprus.

According to ONGC, the Cyprus-based Imperial Energy maintains a total of seven direct subsidiaries: Imperial Energy Cyprus Ltd (IECL), Imperial Energy Nord Ltd (IENL), Imperial Frac Services Cyprus Ltd (IFSCL), Redcliffe Holdings Ltd (RHL), Imperial Energy Tomsk Ltd (IETL), Biancus Holding Ltd (BHL), and San Agio Investment Ltd (SAIL).

ONGC manages its overseas exploration and production of oil and natural gas business mainly through its wholly-owned subsidiary, ONGC Videsh Ltd (OVL). OVL holds one of its assets in Russia through a wholly-owned subsidiary Imperial Energy Ltd (IEL).

The rationale behind this amalgamation is to mitigate administrative costs, estimated at approximately $0.24 million per year (equivalent to ₹2 crore per year), primarily attributed to accounting and audit, statutory payments, and taxes.

The merger is anticipated to yield not only a reduction in administrative costs and taxes but also simplify statutory and tax compliances, enhancing the overall efficiency of financial reporting under a more streamlined management structure, the company added.

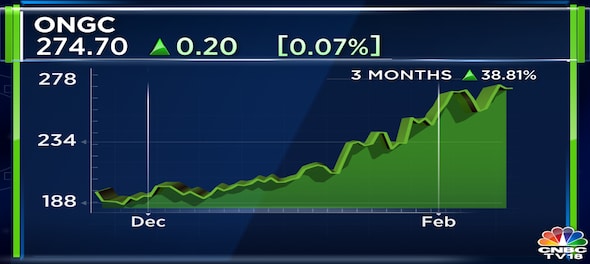

Shares of Oil and Natural Gas Corporation Ltd ended at ₹274.70, up by ₹0.20, or 0.073% on the BSE.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM