To achieve its net zero targets, Oil India's Chairman and Managing Director (CMD) Ranjit Rath announced on Thursday, September 14, that the company wants to invest Rs 25,000 crore in renewable energy by 2040. The CMD said 2040 is Oil India's net zero initiative timeline and the firm is trying to advance it to somewhere around 2038.

The Rs 25,000 crore investment by Oil India would cover a wide spectrum of activities such as green hydrogen, compressed biogas, solar energy, geothermal energy, and zero-flaring initiatives. This investment will also involve transitioning from diesel-fired engines to gas engines.

Furthermore, of the total lump sum, the company intends to spend Rs 8,000 crore on 2G ethanol alone.

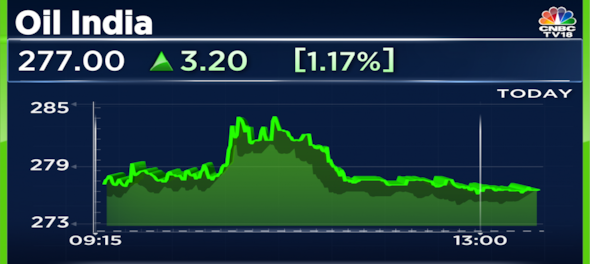

Shares of Oil India were trading nearly 1.2 percent higher at Rs 277 apiece around 1:40 pm after the announcement.

Rath said the company was looking at reducing gas flaring, or the burning of the natural gas associated with oil extraction, to a level zero. "We have initiated a lot of projects in that. We are also looking at capturing stranded gases, compressing and pushing them to the CGD (City Gas Distributors) network," he said.

The CMD shared the company had set up a bamboo-based bio-ethanol plant and was trying to set up another such plant.

On the company's portfolio in renewable energy, Rath said the company had a joint venture with Assam for a 620-megawatt solar power plant and is also collaborating with Himachal Pradesh for a 150-megawatt solar power plant.

Green hydrogen is another portfolio the company is looking at. "Our subsidiary NRL (Numaligargh Refinery) has placed an order for the displacement of grey hydrogen with green hydrogen. We are looking at 20-kilo tonnes per annum capacity of green hydrogen and looking at setting up compressed biogas plants that should cater to our CGD initiative," he detailed.

That's not all, Oil India is also looking at displacing diesel with natural gas for all operations wherever possible and using water injection technology to enhance oil production efforts.

Crude oil prices have been on the rise in recent times, a trend that the CMD views as a "welcome" development. He emphasised that these price increases are closely linked to international oil prices and play a pivotal role in encouraging "upstream players to invest more" in the sector.

Oil India, being a prominent player in the industry, is well-prepared to handle such fluctuations and maintain its production goals, Rath said.

Oil India's current operations primarily focus on mature fields, where the decline rate in production is approximately 8-10 percent. Despite this, the company reported a net growth of 5.5 percent in production last year, with a gross growth of 15 percent.

Rath attributed this success to a "variety of interventions" undertaken by the company.

Looking ahead, Oil India has set ambitious targets, including a mission to achieve 4 metric tonnes of crude oil production and 5 billion cubic meters (BCM) of natural gas production by FY25.

The firm also revealed plans to drill around 60 wells in the main producing areas of Assam and Arunachal this financial year. In addition, the company is looking at six new deep rock well drilling this year and is contemplating deeper wells and deeper horizons.

Rath expressed confidence in the new gas price formula, especially its provisions for difficult fields, which allow for a price band plus 20 percent. "We are now looking at enhancing our gas portfolio very, very aggressively," Rath said.

First Published: Sept 14, 2023 1:56 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM