FSN E-Commerce Ventures, the parent company of Nykaa, posted a 72 percent fall in consolidated net profit at Rs 2.41 crore for the quarter ended March 2023 (Q4FY23) against a net profit of Rs 8.56 crore in the corresponding quarter of the last fiscal year. Falguni Nayar, Executive Chairperson, MD and CEO, spoke to CNBC-TV18 on the company's earnings and plans ahead.

Here is a transcript of the interview:

Q: Tell us more about the quarter gone by and how do you see the fashion segment performing?

A: If you look at it on a two-year basis, I think on the back of COVID-19 receding and many of the stores opening, we found that growth was not easy to come by. I think it's important for us that we grow the right categories, right brands, right mix at the right marketing costs and that is what the focus is. Overall, on a full-year basis, fashion has grown at 40 percent plus on a gross merchant value (GMV) basis and that is healthy growth. And yes, it can accelerate as discretionary spending goes up.

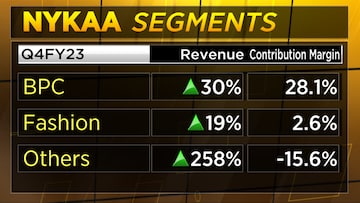

Q: In Q4, you spent about 27 percent of your fashion GMV on marketing, and contribution margin and fashion were just 2.6 percent. So, if it grows at the 40 percent plus mark, that you have been talking about, what is the operating leverage benefit here, what kind of contribution margin and steady-state marketing spends up looking at?

A: I keep saying that in an e-commerce business, the marketing spend is a function of new customer acquisition versus repeat customer acquisition and as the company grows in its journey, for us, it's like the third important year for fashion, technically fourth year, but at scale, it's about three years of operation and customer acquisition. And as that equation improves, marketing costs always come down.

Q: How do you pursue growth in the beauty and personal care business – 30-35 percent – is that sustainable? At the same time, we are looking at contribution margins in the beauty business now stabilising at 28-30 percent – is that sustainable as well?

A: I feel that beauty is in a very good place, both internationally and in India. India and Gulf Cooperation Council (GCC) are recognised as two very important markets for more diversification of growth. US and China are important markets. So, India is becoming a relatively more important market to global brands compared to what it has been in the past. So that is going to lead to a lot of excitement in the beauty industry. And we do believe that that should drive additional growth in the coming year.

Q: You plan to double offline presence. You have done that in the last year, and you plan to increase that. What's the rationale behind that? How do the unit economics of selling offline benefit versus selling online?

A: Post-COVID-19, our offline business has been totally profitable. Not just the store EBITDA, it's total business profitability, which covers all the costs of the business including depreciation and interest costs. So, we are in a very happy place and 90-95 percent of the stores are profitable at the store level. We needed to have that one destination store in most cities and bigger cities like Mumbai, Delhi, and Bengaluru because there are so many catchments. So, we are going to continue with the destination store strategy.

We are present in 65 cities and will go to 100. In the coming year, we will do about 50 stores on the back of the 150 that we already have. So, the piece of growth is going to taper down compared to the past where there was accelerated growth following COVID-19. But I must admit that e-commerce is a far more profitable channel than physical retail.

i

Q: The Street is not very happy with a bunch of things, which is reflected in the stock underperformance. One concern was with regard to the kerfuffle over the bonus issue. Another is concern over new-age business valuations. And then there is competition from larger established players. Which of these concerns are legit and what are you doing for investors’ concerns? There have been some senior exits as well...

A: It is a lot of media highlighting things, which are non-issues. The bonus issue is always considered. It's a very fair issuance, which is benefiting all the shareholders. In terms of voting, 91 percent of the shareholders voted and all of them voted in favour. So, we had not seen any issues. We have also seen that many bonuses were not going to affect any of the new shareholders because their shares were not locked in. If there was any delay in terms of those shares being available to trade, it would affect the pre-IPO shareholders, and most of them have been able to get an exit.

So, most of our underperformance can be attributed to post-lockup or large-cap table changing hands. And we have been monitoring that. Our retail shareholder base has, in fact, gone up from less than 1 percent of the company to 4 percent. Our institutional base, both from mutual funds as well as FIIs, has been constantly going up in a post-bonus environment. So, there is no indication of data or facts that shows that the bonus issue was not right for the investors in the company as well as for the company. So, that's one.

About competition, we are a large, complex business, with more than 15 million transacting users, with stores in 150 cities, 3,500 brands on our platform, and many of them exclusive. Even if some are not exclusive, it’s not that they are widely distributed. A lot of competition concerns don't seem valid from a financial effect on our business perspective. When I entered the business in 2012, soon after, in 2013 Amazon entered the market and everyone kept saying, how will you Amazon-proof the business? So, the challenges for management are more about how they take their business forward in a way that they have the consumer connect and that is where our success lies.

As far as exits of employees were concerned, they were a little bit non-event, it came on the back of past practice of leaving a small company with very high designation compared to sometimes the roles that are being played by those individuals. And I have gone on record post that to say, we have more than 50 such senior executives of which maybe five left.

Q: At current levels, would the promoters perhaps show some intent and buy from the open market and give the signal to the stock markets?

A: We are professionals turned entrepreneurs so the fact that a lot of promoters are committing their life early, both Anchit and Adwaita are very young, at 33 years of age, they have been working for the company for 6-10 years, they are committed to making their career with this company and so am I. I think that itself should be considered as backing enough. I don't want to opine on the stock prices, and it would be the wrong thing to comment on that. But overall, we are always behind the company and behind the stock.

For more, watch the accompanying video

i

i