On this base, the company is expected to grow by another 20% for FY25, SK Jha, CMD, Mishra Dhatu Nigam said in an interview with CNBC-TV18.

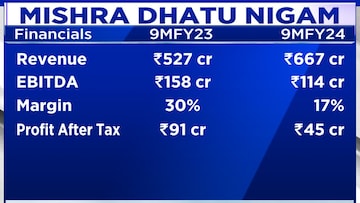

For the first nine months of the year (9MFY24),

MIDHANI witnessed a 27% increase in revenue, reaching

₹667 crore compared to

₹527 crore. However, there was a 27% decline in earnings before interest, taxes, depreciation, and amortization (EBITDA), amounting to

₹114 crore compared to

₹158 crore, resulting in margins dropping from 30% to 17%. Profit after tax (PAT) experienced a 50% decrease, standing at

₹45 crore compared to

₹91 crore in comparison to the same period last year (9MFY23).

He expects to see similar levels of growth in revenues for the current quarter (Q4FY24) as well.

Variation in the raw material prices has put pressure on profits.

However, in the last three months, this pressure on raw material prices has come down and is getting stabilised, the impact of which will be seen in Q4FY24 results or in Q1FY25 results.

“We will have better improvement in our margins because of that,” he said.

The company also serves high-end materials for the aerospace industry, which requires nickel-based alloys than titanium alloys. As the raw material prices across the globe have gone up, the supply chain has been affected, putting pressures on the company's margins.

“Our orderbook also has to grow similarly,” he said. The current orderbook of the company stood at ₹1762.40 crore.

Between the space and defence revenue mix, 60-65% of the revenue is contributed by the defence segment and 20-25% of the revenue will be coming from the space segment in FY24.

It is a Public Sector Undertaking, under the administrative control of the Department of Defence Production, Ministry of Defence, Government of India.

The company earlier had given the guidance of ₹200 crore exports translating into 15% of revenue for FY24. “I am expecting this to further grow in next year. We are attracting many leading aerospace companies of the world,” he said.

As many companies are entering this space, he is confident of remaining competitive. “It is a very challenging market, very competitive market. Since MIDHANI is uniquely placed in this space, we will have the advantage in getting new orders,” he explained.

The current market capitalisation of the company is ₹7,718.41 crore.

For more, watch the accompanying video

(Edited by : Shweta Mungre)