KPIT Technologies reported strong set of financials for the first quarter of FY24. The revenues rose 8.2 percent to $133.9 million versus $123.8 million, while Rupee revenue rose 60 percent to Rs 1,098 crore.

Earnings before interest, tax, depreciation and amortisation (EBITDA) grew to Rs 214 crore versus Rs 182 crore in the same quarter of last year, while margins improved to 19.5 percent versus 17.9 percent in the corresponding quarter of last year.

The profits after tax are 20 percent higher at Rs 134 crore as it includes a one-time gain of Rs 13.4 crore resulting from remeasuring of earlier FMS equity.

$ 190 million worth engagements closed in the quarter with healthy pipeline level across practices.

In terms of geographical performance, US markets revenues are flat quarter on quarter, Europe is 11 percent higher and Asia is 19 percent higher.

Kishor Patil, Co-founder, CEO and MD, KPIT said,”. We have started the year on a positive note and have delivered a robust all-round performance in line with our expectations of a stronger first half. Opportunities remain stronger as mobility players continue to invest in new technologies, in the areas of electrification, vehicle autonomy, connectivity and personalization. We have a healthy pipeline and are slightly ahead in the ramp up of the mega strategic engagements announced last year. This gives us a fair medium-term visibility and we are confident of reaching our stated outlook of revenue growth and operating margins for FY2024”.

Sachin Tikekar, Co-founder and Joint MD, KPIT said,” We are experiencing greater traction with our strategic clients as we move further in creating trusted partnerships with our clients to help them accelerate their transformation. The attrition has been consistently falling over the last 3 quarters. We are investing in improving the quality of hires and building the right competencies and technologies to enable flawless execution. We have started baselining sustainability and co-creating a roadmap with our employees and look forward to scaling our impact in creating a cleaner, smarter, safer world in the years to come through our offerings, operations, and employees.”.

The company maintains its FY24 guidance at 27-30 percent constant currency growth and EBITDA margins at 19-20 percent.

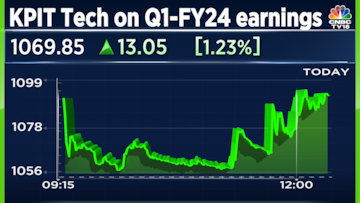

The shares of KPIT are trading 1.2 percent higher on July 25 after publishing a strong set of first quarter results for FY24.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM