RevPAR, or revenue per available room, is a performance metric in the hotel industry that shows the revenue generated per room regardless of whether the rooms are occupied or not.

In an investor presentation being made at the Capital Market Day organised by the company on Thursday, Indian Hotels maintained its margin guidance for financial year 2025 at 33 percent.

To recall, in May 2022, Indian Hotels had announced AHVAAN 2025. Through the plan, the company aimed to boost profitability by re-engineering its margins, re-imagining its brand scape and restructuring its portfolio.

The company now said that management fees guidance has been revised upwards to Rs 550 crore from Rs 400 crore earlier under a new growth campaign for 2025.

Indian Hotels had posted strong numbers for the March 2023 quarter, beating analyst estimates. The company’s revenue had jumped 86.4 percent to Rs 1,625 crore from Rs 872 crore in the year-ago quarter.

The company’s margins had also improved to 33 percent in the March quarter from 18 percent last year.

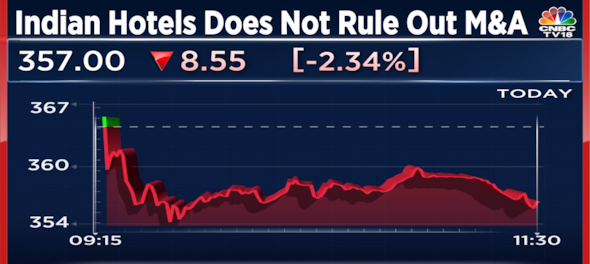

Shares of Indian Hotels were trading at Rs 358.35 apiece, down 1.97 percent, on BSE at 10:43 AM.