Imagine Marketing, the holding company of popular consumer electronics brand ‘boAt’, has filed the Draft Red Herring Prospectus (DRHP) for its Rs 2,000 crore IPO. As per the DRHP, the company is looking to raise Rs 900 crore through fresh issuance of equity and Rs 1,100 crore through Offer For Sale (OFS). The company may also consider a pre-IPO placement of Rs 180 crore which if completed then the fresh issue size will be reduced to the extent of such pre-IPO placement.

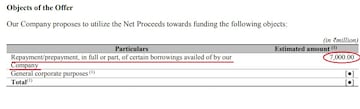

Out the funds raised through fresh issuance of equity, the company plans to use Rs 700 crore towards repayment and prepayment of certain borrowings of the company. Imagine Marketing’s borrowings at the end of first half of the fiscal stood at Rs 731 crore, increasing significantly from Rs 42 crore a year ago. The use of IPO proceeds towards debt retirement is expected to make the company debt free.

Out the funds raised through fresh issuance of equity, the company plans to use Rs 700 crore towards repayment and prepayment of certain borrowings of the company. Imagine Marketing’s borrowings at the end of first half of the fiscal stood at Rs 731 crore, increasing significantly from Rs 42 crore a year ago. The use of IPO proceeds towards debt retirement is expected to make the company debt free.

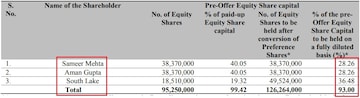

Both co-founders, Aman Gupta (now Shark Tank India fame) and Sameer Mehta, will be selling their shares worth Rs 150 crore each through the OFS part. Also, South lake Investment (an affiliate of Warbug Pincus) will raise Rs 800 crore through selling part of its stake in the company. Promoters Sameer Mehta and Aman Gupta hold slightly over a 28 percent stake each in the company, whereas South lake Investment holds over 36 percent. boAt is the only startup in which the founders together hold over 50 percent at the time of the IPO. Fireside Ventures and Qualcomm hold nearly 4 percent and 2.6 percent in Imagine Marketing, and both will not be selling any of their stake in the IPO.

The two promoters--Aman Gupta and Sameer Mehta--had offloaded their shares worth Rs 23 crore through buyback in February 2021 and since then, haven’t diluted their holdings in the company.

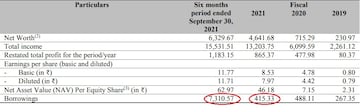

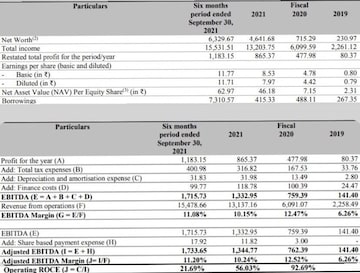

Imagine Marketing generated a revenue of Rs 1,553 crore in first half of FY22, as against Rs 1,320 crore in calendar year 2021 and Rs 71 crore in FY19. On the profitability front, the company generated a net profit of Rs 118 crore in the first half of the fiscal 2022, which compares to 86.5 crore in calendar year 2021 and Rs 48 crore in FY19. The revenue and profit figures look quite astounding when simply annualised. The company also boasts of being profitable on an operational level as it displays an EBITDA (Earnings Before Tax, Depreciation and Amortisation) of Rs 173 crore, which compares to Rs 134 crore in the calendar year 2021. The business has also given the company an EBITDA Margin of 11.2 percent, which compares to 10.24 percent in calendar year 2021. The Return on Capital Employed (RoCE) stood at 21.7 percent at the end of first half of the fiscal, as against 56 percent at the end of the first quarter of the same fiscal. The RoCE at the end of first quarter of FY21 was at 93 percent.

Launched in 2014, the company now controls five brands under its portfolio including boAt, Redgear (acquired in 2020), Tagg (acquired in 2022), wearable brand Defy and its own personal care and grooming brand Misfit. Earlier this month, the company also entered into a joint venture with electronics manufacturer Dixon Technologies to manufacture its products in India.

Besides the risk of competition from old and established players, Imagine Marketing has also highlighted its dependence on online sales as a major risk. Online sales contributed over 86 percent of the total revenue in the first half of FY22 and the number has stayed in this neighbourhood in the past three years. A risk within the risk is also high dependence on platforms such as Amazon and Flipkart for sales. This leaves the company vulnerable to any policy changes which these online platforms make.

The company, in its DRHP also highlights the risk around any kind of shortage in supply from contract manufacturers or component suppliers. The risk arises because almost 100 percent of products which boAt sells are imported from China, and most of them from five most-used suppliers. To combat this the company plans to put more Joint Ventures (JVs) for manufacturing in India. The most recent example of this was the JV which boAt signed with Dixon Technologies to design and make wireless audio devices in India.

boAt’s IPO comes at a time when a major valuation adjustment is underway in the Indian market. Recently listed startups like Paytm, PB Fintech, Zomato, NYKAA and many more are down anywhere between 40-60 percent from their highest level. Only time will tell whether it will be rough or smooth sailing for boAt.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM