The employee costs at corporate India grew at a slowest pace in 10-quarters as software firms slowed down their net hiring due to weak demand environment. September quarter was the sixth consecutive quarter where IT firms clocked some decline in hiring.

While the total workforce base at Infosys declined by 7,530 in September quarter, the largest IT firm –Tata Consultancy Service (TCS) – saw its headcount falling by 6,333. For HCL Technologies, the fall in headcount was 2,399. The three top technology service providers spend more than half of their revenues to meet employee expenses. Further, most IT companies reported muted sequential growth in Q2 revenues with bleak outlook.

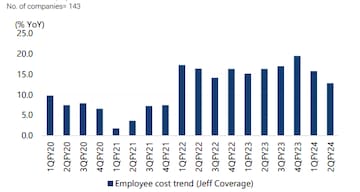

According to a Jefferies note, the employee cost of companies under its coverage grew 12.8% in September quarter –the lowest in ten quarters. "IT companies reported tepid 0.3% quarter on quarter (QoQ) revenue growth but weak outlook with guidance cuts and net employee count declines seen across IT majors," said the foreign brokerage in a note dated November 16.

Among the sectors, financials and Autos lead the table whereas IT, Capital goods and Metals lags in employee cost trends. While the employee cost of Financials surged by 29.1% year on year (y-o-y), the Auto sector clocked a growth of 26.3% in September quarter. The wage bill of companies in IT, Capital goods and Metals increased by less than 10% during the quarter.

However, despite delayed festive and weak sentiments, India Inc managed to deliver decent set of numbers in Q2, driven by domestic companies. Auto companies like Maruti Suzuki and Tata Motors reported robust set of numbers during the quarter. Additionally, realty firms saw 55% YoY rise in pre-sales due to strong response to new launches.

While Tata Motors swung to profit in September quarter, Maruti posted better-than-expected earnings boosted by its revamped lineup of sports utility vehicles and lower input costs. Similarly, decline in input cost boosted cement companies margin after multiple quarters.

First Published: Nov 17, 2023 10:38 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM