FMCG major Hindustan Unilever Ltd. reported 4 percent domestic volume growth during the January-March period. A CNBC-TV18 poll expected the company to report volume growth between 5-6 percent.

For the full year, the company reported volume growth of 5 percent.

For the quarter, the company reported a net profit of Rs 2,552 crore, lower than the CNBC-TV18 poll of Rs 2,580 crore. Revenue of Rs 14,893 crore also missed expectations of Rs 15,250 crore. Year-on-Year, revenue increased by 10 percent.

Operating profit or EBITDA at Rs 3,471 crore was lower than the CNBC-TV18 poll of Rs 3,650 crore, while margin at 23.3 percent, was 70 basis points lower than the expectation of 24 percent. Year-on-Year, margin declined by 80 basis points.

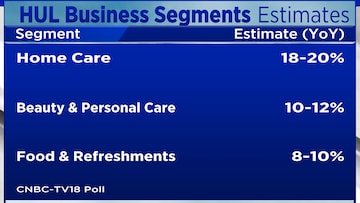

Among HUL's business segments, the Home Care business grew at 18.7 percent, compared to a CNBC-TV18 poll of 18-20 percent growth. Beauty and Personal Care also grew at the lower end of the expectation range. Both the businesses contribute 35 percent each to the company's topline.

However, the Food and Refreshments business grew in low-single-digits, compared to expectations of high-single-digits.

The company mentioned that the premium portfolio within the home care business continued to outperform the rest of the portfolio. Surf Excel, the detergent, became the first home and personal care brand in India to cross $1 billion in turnover.

Home care liquids also crossed Rs 3,000 crore in annual revenue in financial year 2023.

"Versus our expectation the numbers are largely in line, versus street it is bit lower," said

Abneesh Roy of Nuvama Institutional Equities. He said that after strong numbers from Tata Consumer and Nestle India, there were expectations of a beat here as well, but HUL being a larger category, there was inflation in some parts which had a lagged effect.

"My sense is from Q1, you will see the improvement in trajectory in terms of margins and clearly the rural slowdown, which we had called out earlier, also, that does impact it HUL’s portfolio. So overall numbers slightly below street expectation, but versus our expectation, it is fairly close," Roy said.

On the charts, Aditya Agarwala of Invest4edu said that the selling pressure in HUL's shares is likely to continue. "I would not want to get into an HUL at current levels, because there could be some more correction in the offing. So it is clearly an avoid at the moment and it has been underperforming the FMCG pack for some time," he said.

Shares of Hindustan Unilever are off the day's high, currently trading 1.5 percent lower at Rs 2,473.75.

First Published: Apr 27, 2023 12:30 PM IST