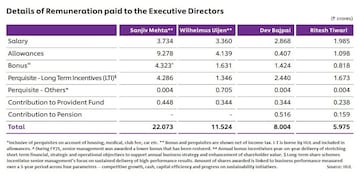

The remuneration of the managing director and chief executive of India’s largest fast-moving consumer goods Hindustan Unilever Limited (HUL), Sanjiv Mehta, grew nearly 44 percent in FY22 to Rs 22.073 crore against the previous financial year.

This was 179.61 times more than the median remuneration other employees took home in a year of unprecedented input cost inflation impacting consumer demand. There was a 3.3 percent increase in the median remuneration of employees in FY22. The company had around 8,500 permanent employees as of FY22.

Mehta's remuneration includes a bonus of Rs 4.323 crore and a perquisites long-term incentive of Rs 4.286 crore. The company said in the annual report that the senior management was awarded a lower bonus in FY21 that has now been restored to normal levels. FY21 saw large pay cuts and bonus withdrawals for senior management on account of COVID-19. That year, Mehta’s annual gross salary of Rs 15.36 crore was 20.9 percent lower compared to the previous fiscal (Rs 19.42 crore), which included a bonus of Rs 2.02 crore and perquisites of Rs 1.69 crore.

However, the company remains confident of outpacing the FMCG market growth and is confident of maintaining margins at healthy levels.

Also Read:

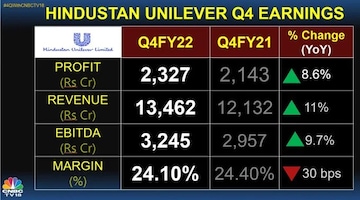

In FY22, HUL saw its turnover cross the Rs 50,000-crore mark and 16 brands of HUL saw a turnover of over Rs 1,000 crore. The FMCG major clocked a profit of Rs 8,818 crore while the underlying volume growth came in at 3 percent for the year. However, rising input costs meant that the EBITDA margin for FY22 was lower than FY21.

However, the company continues to remain confident in its growth prospects. “More people entering the middle class, a large working population, increasing nuclear family structures, urbanisation and rapid adoption of technology, all bode well for FMCG growth in the country,” Paranjpe said.

In its outlook for FY23, the company has maintained that in the mid-term, it will continue to “create value for all stakeholders by growing ahead of the market, delivering modest margin expansion and through disciplined use of capital.”