Before December 2021: ITC = Memes

Post December 2021: ITC = Returns and outperformance. The stock has doubled from December 2021.

During this dream run, ITC emerged as the top performer on the Nifty 50 in 2022 and ranks among the top performers this year as well.

At the same time, HUL has gained only 6 percent so far this year, compared to ITC's 33 percent.

But let us zoom out a little and take a slightly longer time frame. When we compare returns of the two over a five-year time period, they are nearly the same. This means both had their periods of outperformance; HUL first, and ITC recently.

However, recent data is pointing to HUL slowly but steadily saying "apna time aayega." (Our time will come)

HUL's shares have outperformed those of ITC over the last one month, rising over 10 percent, compared to ITC 3.5 percent advance.

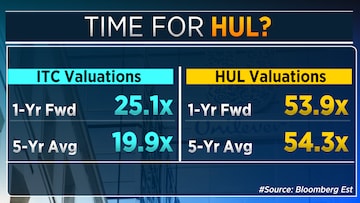

The basic premise that triggered the rally in ITC's shares, aside of the multiple tailwinds, was the fact that the stock is grossly undervalued. But after its breathtaking rally in which it has continued to scale one record high after another, ITC's shares are trading at a 25 percent premium to its own historical valuation. When the stock began to rally, it traded at a 30 percent discount to its historical valuation.

In the case of HUL, the stock is currently trading at an 8 percent discount to its historical valuation. At its peak, it traded at a 25 percent premium to the average.

Valuation-wise, ITC has always been the proverbial No.2 to HUL, always trading at a discount compared to its bigger rival. But that discount, courtesy of the recent rally, is starting to narrow. The discount currently stands at 53 percent, which at one point stood at an average of 60 percent, and at their lows, it even widened to as high as 80 percent.

Another factor that works in HUL's favour going forward, is that ITC now enters a period of high growth performance in the base quarter, while HUL has a lower base and also has a few triggers going for it.

The most important one being a change at the helm. Rohit Jawa will take charge of the company on June 27. This, after Sanjiv Mehta retires after more than a decade at the helm of affairs.

Consensus around the street is that inflationary pressures have peaked, resulting in lower input costs. If this does turnout to be true, the lower input costs will lead to better margins for the company.

Prospects of a normal monsoon, India heading into an election year points towards a focus on the rural economy. Any substantial recovery there would be beneficial for HUL. Lastly, scaling up of acquisitions like V-Wash, Oziva etc. will also be beneficial for the company. As of March 2022, HUL had 19 brands with an individual turnover of Rs 1,000 crore each.

So has HUL's time come? Will it Surf higher as it has been over the last one month? Or will ITC continue its dream run? Those are some questions that we will eagerly await answers too.

(Edited by : Hormaz Fatakia)

First Published: Jun 5, 2023 9:07 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM