Hindalco Industries is likely to consider investing in Hindustan Copper if the government plans to divest its stake in it, Managing Director (MD) Satish Pai signalled on May 25.

When asked if the firm would be interested if NALCO and Hindustan Copper are up for divestment, Pai told CNBC-TV18, “I think on Hindustan Copper, we will certainly be taking a very good look.”

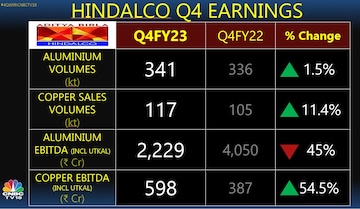

Hindalco MD’s comment comes a day after his company posted the highest ever operating profit for its copper business for the January to March 2023 quarter, even as its overall EBITDA declined over 45 percent during the three-month period, the company’s financial results showed on May 25.

In a statement the day before, he said, the firm’s record operating profit or EBITDA was on the back of robust market demand, stable operations and higher value-added product sales.

The metals manufacturing firm has also been able to bring down its net debt by nearly 18 percent in the March 2023 ended quarter, following the working capital release at its US subsidiary Novelis.

Now that the debt is under counter, when asked if Hindalco could diversify and consider the likes of NMDC Steel as the government looks to divest, Pai said his firm will continue to focus on its core aluminium and copper businesses. "We will certainly take a look but not steel.”

While Hindalco’s aluminium business has improved sequentially, reflecting on how much more can it improve from here on, Pai said he expects the LME aluminium price band of $2,200-2,400 per tonne and expects operating profit per tonne to come in around $700-800 per tonne in the first half of the current fiscal year.

Pai said costs per tonne were down by 6 percent on a quarter-on-quarter basis due to better coal availability and lower e-auction prices. He expects the cost to remain flattish as coal availability could get tight in the first quarter of FY24.

Meanwhile, Pai expects copper EBITDA to cool off to Rs 350-400 crore in the first quarter of FY24 due to a shutdown, post this quarter move back towards Rs 500 crore plus.

While the performance of Hindalco’s

US subsidiary Novelis was disappointing in the quarter gone by, the firm expects the operating profit to be in the range of $430-475 in the first half of FY24, while in the second half of the financial year, it is expected to improve to $500 per tonne.

Hindalco is not going to pare down any more debt this year, Pai said. “We are going to put most of the cash generated towards the capex because Novelis will have $1.8 billion worth of capex for the large US plant that's going on,” he said.

In India, the firm will spend around Rs 5,000 crore on capex. So, overall Hindalco has quite a large capex planned this year and most of the cash will be going towards capex, Paid said.

Watch the accompanying video for more

First Published: May 25, 2023 9:45 AM IST