Shares of ICICI Prudential Life Insurance Company have come to an interesting level. The stock closed at Rs 444.3 on Friday last week and is now up by 0.37 percent from the previous level on the BSE.

In terms of downtrends, in March 2021 the stock went below the point of Rs 444.3 and in March 2022 too the stock went below the price and then saw a decent rebound. Now as the year is coming to an end the stock is back at the level of the previous two downturns. Its stock price quoted a 52-week high of Rs 640.0 and a 52-week low of Rs 430.0.

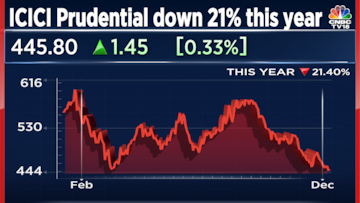

In the year so far ICICI Prudential Life Insurance has declined over 21 percent. It is below the 2019 closing level Importantly as the stock has seen a decent rebound after the downsides in the past it would be interesting to keep the stock in radar to see what happens now.

In the year so far ICICI Prudential Life Insurance have declined over 21 percent.

Importantly as the stock has seen a decent rebound after the downsides in the past it would be interesting to keep the stock in radar to see what happens now. The challenge for the stock has been not many policy additions in the entire life insurance sector.

ICICI Prudential Life Insurance Annual Premium Equivalent (APE) which is the sum of the initial premium on new annual-premium policies, plus one-tenth of premiums on new single-premium policies has been more volatile than peers due to a higher share of Unit Linked Insurance Plans.

ICICI Prudential Life Insurance reported an over 55 percent decline in its net profit to Rs 199 crore for the July-September quarter. In the corresponding period a year ago the net profit stood at Rs 445 crore.

"On the back of this strong VNB growth and with a favourable premium base for the coming months, we believe we are on track to achieve our objective of doubling our FY2019 VNB by the end of this fiscal year," said N S Kannan, MD & CEO, ICICI Prudential Life Insurance.