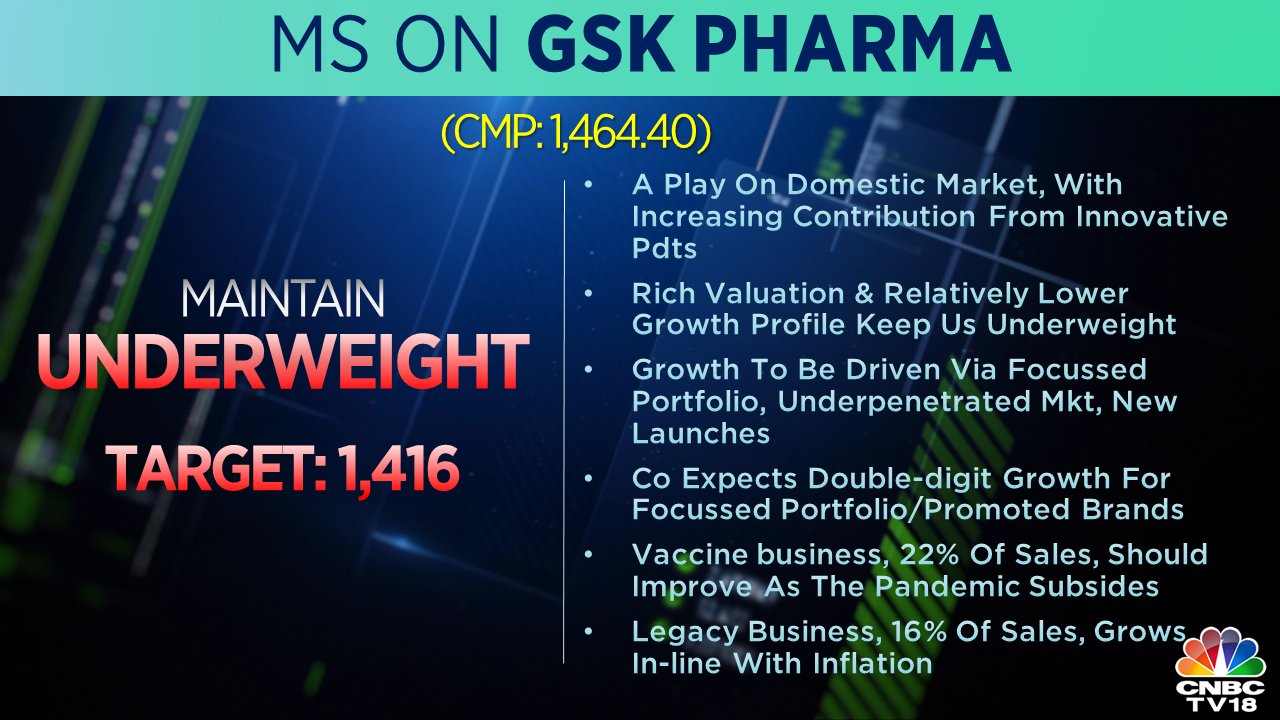

Shares of GlaxoSmithKline Pharmaceuticals (GSK Pharma) fell over 1 percent on Wednesday after brokerage firm Morgan Stanley maintained an ‘underweight’ rating on the stock owing to the company's rich valuation and relatively lower growth profile.

Morgan Stanley also cut its target price from the earlier Rs 1464.40 to Rs 1,416 per share. At 09:48 shares of the pharma company were trading at Rs 1448, a 1.05 percent decline from the previous close on the BSE.

Morgan Stanley noted that GSK Pharma is a key player in the domestic pharmaceutical market with its increasing contribution and innovative products.

The vaccine business contributes 22 percent of sales for GSK Pharma, Morgan Staley estimated that this should improve as the pandemic subsides.

In a regulatory filing last month the company mentioned that its consolidated net profit for the April-June quarter increased by 8 percent and stood at Rs 116 crore in comparison to Rs 107 crore in the corresponding period last year.

Also read: Wednesday's top brokerage calls: Reliance Industries, GSK Pharma, Abbott and IndusInd Bank

Revenue from operations rose to Rs 745 crore as against Rs 718 crore in the year-ago period.

"Our results reflect good momentum across general medicines and vaccines during the quarter. We have delivered strong underlying growth with market share gains across focus brands," GlaxoSmithKline Pharmaceuticals MD Sridhar Venkatesh noted.

GlaxoSmithKline Pharmaceuticals is a subsidiary of GlaxoSmithKline plc, one of the world's leading research-based pharmaceutical and healthcare companies.

First Published: Aug 24, 2022 11:37 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court verdict on EVMs — why upholding the voter’s trust is important

Apr 27, 2024 2:23 PM

BJP spent more than ₹103 crore on Google Ads since May 2018, maximum expenditure on videos

Apr 27, 2024 11:39 AM

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM