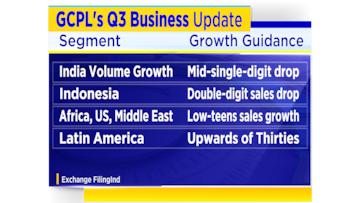

Godrej Consumer Products Ltd., one of the leading players in household, air care and aircare products in Emerging Markets expects its India business volumes to drop in mid-single-digits in the September quarter considering "soft trends" in the domestic FMCG industry.

The India business contributes nearly 60 percent to the company's overall topline and over 80 percent of the company's earnings before interest, taxes, depreciation, and amortisation (EBITDA). As a result, the company expects a mid-teens drop in its operating profit. It has cited consumption of high cost materials, significant upfront marketing investments to drive category development, and a weak performance in Indonesia, behind the warning.

Excluding the Africa region, Indonesia is GCPL's second-largest individual market by country. The company expects the Indonesia business to report an early double-digit sales drop in constant currency terms due to waning of demand for hygiene products after Covid-19.

However, on the sales front, the company expects sales growth in the high-single-digits for the quarter, led by the personal care and home care business. It also expects constant currently sales growth in the high thirties for its Latin America business.

The company is also confident of a recovery in consumption and expansion in gross margins due to a significant correction in commodities like palm oil derivatives and crude oil. It expects sales to grow both in Indonesia (excluding hygiene), as well as its GAUM (Godrej Africa, Middle East, USA) business.

Despite the management's weak commentary, Goldman Sachs sees Godrej Consumer as a strong turnaround candidate as growth in India's homecare business improves. The firm is also witnessing initial signs of recovery in the Indonesia business. It expects lower input costs to aid margins and a sustained double-digit growth in the Africa business due to the company's distribution initiatives.

Shares of Godrej Consumer are down 7 percent this year and have corrected over 20 percent from its 52-week high.

First Published: Oct 6, 2022 8:30 AM IST