Global wealth management firm Bernstein on Tuesday initiated coverage on logistics company Delhivery Ltd. with a ‘Market-Perform’ rating and a positive long-term view.

Bernstein gave a price target of Rs 360 on the Delhivery stock, implying an upside potential of around 11 percent from Monday’s closing level of Rs 323. The price target is 26 percent below the company's IPO price of Rs 487.

Shares of Delhivery have declined 33 percent from their initial public offering (IPO) price last year and 54 percent from their peak, primarily due to poor execution.

Corrective actions by the management in recent months will drive a recovery in earnings, helping some recovery in the stock, said Bernstein. However, the long queue of exits by private equity (PE) investors will cap returns, it added.

“Over 40 percent of the stock is still held by PE/VCs (venture capital) who have sold over 10 percent after the IPO. This continuous churn will cap the upside for a while,” Bernstein said.

Bernstein expects a recovery in both growth and margins for Delhivery in the March quarter after three quarters of weakness. Recovery is expected as the challenges faced by Delhivery in PTL (part truck load) and e-commerce segments are getting resolved.

Delhivery acquired Spoton in 2021 to scale up its B2B (business-to-business) franchise in the PTL space. However, integration with Spoton took longer than expected, thereby impacting volumes. PTL volumes were down 14 percent year-on-year and 50 percent quarter-on-quarter in the April-June period last year.

“We expect Delhivery’s PTL revenues to decline 30 percent on a proforma basis for financial year. Post that, we have assumed a 15 percent volume growth rate until financial year 2030 — given it will reap the benefits of synergy with Spoton and launch economy PTL services,” Bernstein said in its report.

It added that a return of growth in PTL and continued scale increases in e-commerce will help Delhivery utilise its fleet better, helping it return to an operating profit on an adjusted basis in the new financial year. An accounting PAT (profit after tax) breakeven is likely only in financial year 2026, the report mentioned.

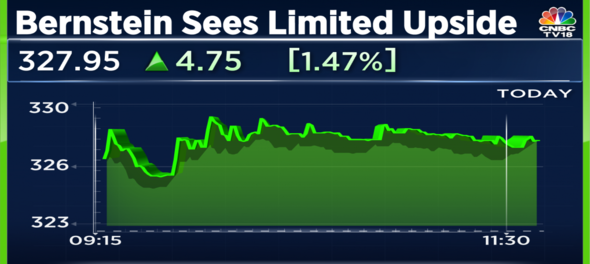

Shares of Delhivery are trading 1.3 percent higher at Rs 327.55.