The board of financial services firm Religare Enterprises Ltd (REL) on Monday (November 20) vehemently denied allegations against the company and its Executive Chairperson Rashmi Saluja.

"The Religare Board denies all allegations raised by certain people with vested interests. The Board and the Management are committed to the highest levels of governance, ethics and integrity," the company said in a regulatory filing.

The Burman family, promoters of the FMCG major Dabur India, has been engaged in a tussle with the REL management ahead of the regulatory approvals for the open offer.

The Burman family has accused Religare's existing management of lapses in corporate governance, while the company has levelled allegations against the Dabur promoters, ranging from fraud, collusion with Malvinder and Shivinder Singh, and other breaches.

Regarding the sale of shares by Saluja, the statement clarified that the liquidation of her ESOPs was part of a process initiated days before a meeting on September 20, 2023.

The shares were sold at the prevailing market price, and the proceeds were reinvested in ESOPs of the Religare Group entity, following standard corporate practices and approvals, it said.

Further, the controversy extends to the ESOP grants related to CARE Health Insurance. Saluja, as an employee of REL, was granted options to purchase shares of CARE.

The company asserted that the issuance of ESOPs was in full conformity with regulatory guidelines applicable to insurance companies. The reported remuneration, including the perquisite value of exercised ESOPs, was clarified to be in line with performance-linked structures and approved by relevant authorities.

Regarding the remuneration paid to Saluja, the statement emphasised that it was performance-linked and had received approvals from the NRC, the board, and shareholders.

Contrary to the allegations, the company stated that the executive chairperson's remuneration for the fiscal year 2022-23 was ₹42.06 crore, not exceeding ₹150 crore as claimed.

The Burman family had filed a complaint with regulatory authorities seeking a probe into the sale of shares by Saluja. Entities controlled by the Burman family have written to the Securities and Exchange Board of India (SEBI) and stock exchanges that Saluja sold a portion of her personal holdings in Religare Enterprises a day after meeting a representative of the Burmans on September 20 — immediately after the Burmans disclosed to her that they intended to make an open offer for the financial services firm.

Saluja was informed about plan of the Burmans —who hold a 20.15% stake in REL and had bought a further 5% — to make an open offer to buy another 26% stake from the open market to take a controlling stake in the financial services firm, said, Dabur India Chairman Mohit Burman.

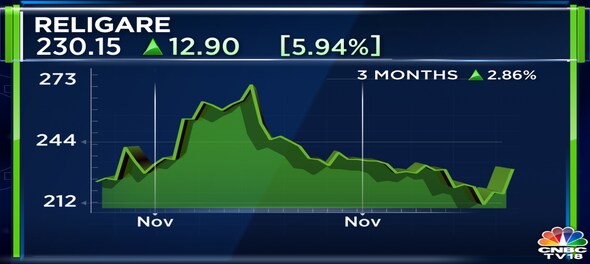

Shares of Religare Enterprises Ltd ended at ₹230.15, down by ₹12.90, or 5.94%, on the BSE.