Bharat Petroleum Corporation Ltd. will be the last among India's oil refiners to report its September quarter results on Monday, November 7. The street is anticipating BPCL to report a net loss as well, following the line of its peers Hindustan Petroleum and Indian Oil.

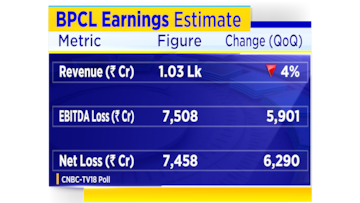

The company had reported a net loss of Rs 6,300 crore during the June quarter. A CNBC-TV18 poll expects the company's revenue to decline 4 percent on a sequential basis.

CNBC-TV18's calculations expect BPCL to receive a one-time LPG grant of Rs 5,500 crore from the government. This comes after Indian Oil received a grant of Rs 10,800 crore and HPCL received a grant of Rs 5,617 crore.

OMCs have not been able to raise prices recently to aid the government combat inflationary pressures.

CNBC-TV18 had exclusively reported earlier that Oil Marketing Companies may seek government intervention as they are weighed down by fuel under recoveries. Sources said that the combined under recoveries for LPG and fuel are over Rs 1 lakh crore.

As has been the case with BPCL's peers, the company's operating loss is likely to be driven by negative marketing margin and a sequential drop in Gross Refining Margin (GRM).

For the September quarter, BPCL's reported GRM is likely to fall to $4.36 per barrel, compared to $25.6 per barrel during the June quarter. On the other hand, the company's Blended Gross Marketing Margin is likely to be a negative Rs 5.2 per litre.

Similar to its peers, BPCL is also likely to report inventory losses in both refining and marketing segments. An inventory loss occurs when a company buys a product at a higher price, but is forced to sell it at a lower price.

BPCL's refinery throughput is expected to reach 10 Million Metric Tonnes (MMT), growing 3 percent from the June quarter and 39 percent from the same period last year. This will be led by a ramp-up of utilisation at the company's Kochi refinery.

Shares of BPCL are down over 21 percent this year, second to HPCL, shares of which have declined nearly 30 percent year-to-date.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 35% voter turnout recorded by 1 pm

Apr 26, 2024 9:11 AM