"Defence will contribute 10 percent to revenues in FY24 versus 2 percent in FY23" says Baba Kalyani, Bharat Forge. He adds "Defence will contribute 20 percent to topline by FY26"

The auto player

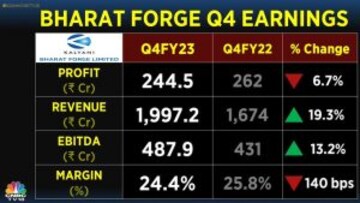

declared its fourth quarter results today with a miss on all fronts when compared with CNBC-TV18 poll, but the performance was better on a year on year basis. The stock fell 3 percent to the day's lows in reaction to the quarterly update, but recovered in later part of the day.

On a standalone basis, for the fourth quarter of financial 2022-23, the revenues rose 19 percent to Rs 1,997 crore on a year-on-year basis, but is lower than CNBC-TV18 poll of Rs 2,048 cr. The company says, the revenues of Rs 1,997 crore is the highest so far with sales increasing across all business areas and regions.

In an interaction with CNBC-TV18 on Friday, Baba Kalyani gives confidence to shareholders with strong Indian operations and expects the momentum to continue. Further, its overseas business was a drag but is expected to witness a turnaround in FY24.

"We are looking at growing our business at a high pace" says Kalyani.

Furthermore, the company is expecting to clock high double digit growth in FY24, while margins are expected in the range of 17 to 19 percent. Furthermore, the company has a comfortable cash balance of Rs 3,200 crore and does not have major capacity expansion plans in FY24. Kalyani says "Large part of the debt will be paid off in the next few years".

Bharat Forge has acquired three castings companies in south India in FY23. Bharat Forge is also in talks with bankers for BEML acquisition, but is currently foreseeing many issues with respect to this company which need a resolution before taking further interest. This includes manpower, valuations and a diverse product line of BEML, some of which Bharat Forge is not interested in venturing into. This shows that the interest in BEML is waning.

The shares of Bharat Forge ended Friday lower by 1.4 percent.