Bharat Electronics Ltd (BEL) had a stellar performance in Q1FY23, with a solid beat on all the fronts compared to a CNBC-TV18 poll. Owing to better-than-expected execution of the key contracts, standalone revenue jumped 90 percent year-on-year (YoY) from Rs 1,635 crore in the April-June 2021 period to Rs 3,113 crore in the first quarter of the current fiscal, marking the best Q1 topline ever. It is noteworthy that Q1FY22 presents a low base owing to Covid and supply chain issues, primarily semi-conductor shortages.

The EBITDA margins jumped from 3.9 percent in Q1FY22 to 16.5 percent in Q1FY23 owing to better operating leverage. This is significantly higher than the CNBC-TV18 poll of 12.6 percent. Profit after tax (PAT) grew 40 times YoY to Rs 431 crore in Q1FY23 compared with 11 crore in Q1FY22 and CNBC-TV18 poll of Rs 184 crore.

BEL order book marginally grew to Rs 5,530 crore as on July 1, 2022 compared to Rs 5450 crore as on July 1, 2021. However, Q1FY23 order inflows were weak at Rs 827 crore, the lowest first quarter inflow in the last 6 years. Axis Capital expects order inflows to rise 14 percent YoY to Rs 20,500 crore in FY23. Credit Suisse says strong execution and lower inflows balance out Q4FY22 performance of low execution and large inflows.

Jefferies believes that the Indian government’s focus on defence indigenisation will only accelerate with the Russia-Ukraine war especially given Russia accounts for over 40 percent of India’s defence imports. The Ministry of Defence is proactively discussing with BEL about finding alternatives for its Russian vendors and to give a roadmap on how it will eventually indigenise the imported components.

Additionally, discussions are on for O&M of Russian aircrafts which have Electronic Warfare Systems to be taken up by BEL based on capability available. This improves medium-term visibility for BEL’s revenue growth prospects.

Additionally, the chip shortages which hurt FY22 revenue growth are easing out. As much as Rs. 820 crore of the Rs 2600-2700 crore of execution impacted has been booked, with the balance is expected in the coming quarters. Revenue growth guidance has not been raised as there is a cumulative effect of chip shortage impact on other deliveries also and the Rs Rs 2600-2700 execution is a part of the FY23e guidance of 15 percent revenue growth with 21-23 percent margins.

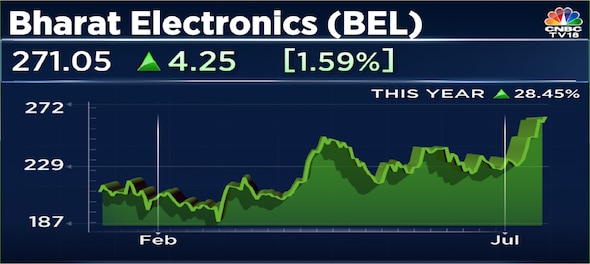

BEL stock price has surged over 28 percent so far this year. However, some downside risks to its performance could be a slowdown in the push for defence indigenisation and unsustainable cost control measures.

First Published: Jul 25, 2022 2:57 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM