BEML had a good show in the fourth quarter of the financial year 2022-23 with a margin-led beat on the operational front. The net profits improved 19 percent year on year to Rs 158 crore. Earnings before interest, tax, depreciation and amortisation (EBITDA) jumped 25 percent to Rs 287 crore.

Revenues though have declined in the fourth quarter by 18 percent to Rs 1,388 crore. The EBITDA margins improved to 20.6 percent versus 13.6 percent in the same quarter of last year due to a favourable product mix and exports to Cameroon worth Rs 150 crore. BEML supplied over 70 units of earth-moving equipment for the Cameroon Cassava project.

Order inflow registered strong growth supported by the Rs 6,780 crore Vande Bharat order. The order book is now at Rs 8,800 crore. The company's order pipeline stands robust with metro as well as defence orders to be finalised in FY24.

Amit Banerjee, Chairman and Managing Director at BEML in an interaction with CNBC-TV18 said "We have received an order for 10 trainsets (Sleeper) on Vande Bharat platform from Integral Coach Factory, Chennai. The total value of the order is Rs 675 crores. This is a joint development between ICF and BEML". The company expects further orders for Vande Bharat trains in future.

BEML is also the lowest bidder for Bangalore Metro and expects to receive its order next month for Rs 3,100 crore. The company also expects new orders from Russia, Indonesia and Mozambique. Banerjee said: "Raw material prices are stable and we hope to increase our margins with a good product mix that includes a higher share of export orders". There are more orders expected for high-mobility defence vehicles.

On the outlook, the company expects the order book to cross Rs 12,000 crore by June 2023 and reach Rs 15,000 to Rs 16,000 crore by the end of FY24. Furthermore, revenues are expected at Rs 4,500 to Rs 5,000 crore in FY24 compared with Rs 3,899 crore in FY23. Physical and deemed exports are expected to grow to Rs 1,000 crore in FY24, including Rs 250 crore for physical exports.

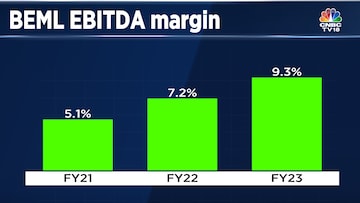

"Due to a favourable product mix of rail, metro and defence, our margins are going to be better as compared with last financial year." The company clocked the highest-ever EBITDA margins of 9.3 percent in FY23.

Antique Broking has a positive stance on BEML and expects robust earnings momentum to play out from FY23 to FY25. The brokerage has assigned a 'buy' rating with Rs 1,695 as the target price.

The stock is trading 1 percent higher on the exchanges at Rs 1,442 on May 31 at noon.

(Edited by : Vahishta Unwalla)