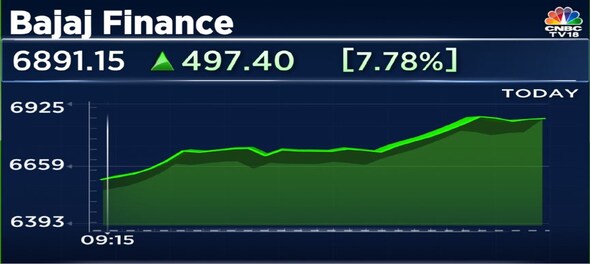

Shares of Bajaj Finance jumped nearly 10 percent on Thursday, a day after the non-banking financial (NBFC) firm reported its highest-ever consolidated quarterly net profit at Rs 2,596 crore for the June quarter, helped by robust income due to brisk loan growth. The company had reported a net profit of Rs 1,002 crore in the year-ago period.

Total income rose by 38 percent to Rs 9,283 crore during the June quarter as against Rs 6,743 crore in the corresponding quarter last year, Bajaj Finance said in a regulatory filing on Wednesday.

“Customer franchise stood at 6.03 crore as of June 30, 2022, as compared to 5.05 crore as of June 30, 2021, a growth of 20 percent. The company recorded the highest ever quarterly increase in its customer franchise of 27.3 lakh in Q1 FY23," it said.

Interest income grew by 33 percent in the first quarter of FY23 to Rs 7,920 crore when compared with Rs 5,954 crore in the same quarter of FY22. New loans booked by the NBFC jumped by 60 percent during the quarter under review to 74.2 lakh from 46.3 lakh in the preceding year.

Assets Under Management (AUM) rose by 30 percent to Rs 2,04,018 crore at the end of June 2022 from Rs 1,59,057 crore in the previous year. The NBFC arm of the Bajaj group said its loan losses and provisions for the quarter came down at Rs 755 crore as against Rs 1,750 crore last fiscal.

On the asset quality, the company’s gross NPAs (Non-Performing Assets) during the period under review fell to 1.25 percent and net NPAs at 0.51 percent, as against 2.96 percent and 1.46 percent, respectively at the end of June 2021. The capital adequacy ratio (including Tier-II capital) in the June quarter was 26.16 percent. The Tier-I capital was 23.84 percent.

The consolidated earnings include results from subsidiaries — Bajaj Housing Finance and Bajaj Financial Securities.

“On April 7, 2022, the company has invested a number of Rs 2,500 crore in Bajaj Housing Finance (BHFL), a wholly-owned subsidiary of the company by subscribing to 1,828,822,235 equity shares of face value of Rs 10 each for cash at Rs 13.67 per share, offered on rights basis," Bajaj Finance said.

Brokerage calls

After strong numbers, global brokerage JP Morgan upgraded Bajaj Finance, raising stance from an earlier 'neutral' to 'overweight' and a higher target price of Rs 8,500. It said almost all key metrics showed positive traction and credit costs have come down to normalised levels.

Morgan Stanley also has an overweight stance with a target price of Rs 8,000 per share. CLSA has a 'sell' rating with target price of Rs 5,600 from an earlier Rs 5,000, while Jefferies has a 'hold' rating with target at Rs 7,300 from its previous call at Rs 7,600. Both Citi and Bank of America have 'buy' calls with target of Rs 8,400 and Rs 8,345, respectively.

Experts view

On Bajaj Finance stock, market expert Prakash Diwan said, "It is a business that has always been very promising. I don't think we've ever had doubts about that. This is a stock that you buy, on bad days or if the market corrects."

Sharekhan's Binod Modi said, "These earnings seem to be ahead of estimates, so there should be some sort of earnings upgrade as well. The stock has not done very well in last couple of months and has underperformed, so given the kind of earnings upgrade that we may see and with the 20 percent plus kind of RoE that the company has been reporting, I think the stock see some sort of rerating going forward.”

At 9.35 am, Bajaj Finance share price was quoting at Rs 6,813 on BSE, up 6.5 percent after opening at Rs 6,514.

(Edited by : Ajay Vaishnav)

First Published: Jul 28, 2022 9:47 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM