Angshu Mallick, MD & CEO of

Adani Wilmar sees significant scope of growth in the branded food segment, particularly in staples, spices, sugar, pulses, wheat flour etc.

In a conversation with CNBC-TV18, he pointed out that the share of branded products in these categories is still much smaller and that provides Adani Wilmar the opportunity to ramp up and grow.

He expects the food division to grow fast and the share of food and FMCG sales to total business to grow to 15-18% from 10% now.

During April-December 2023, the food and

FMCG segment constituted 10% of the total revenue of ₹3,653 crore. Volume growth for the segment was at 19% for the nine months.

Adani Wilmar is also eyeing double-digit volume growth for edible oil in the fiscal year 2025. .

Mallick said, “Possibly after four or five years, the country is seeing higher consumption of edible oil. As a result, the overall business of edibles has improved in terms of volume. Prices are low so consumption are higher. Q4 should be also equally good in terms of volume. Going forward, the country is likely to consume more edible oil because of the stable prices, we see this consumption overall continuing so FY25 might be a little better than FY20.”

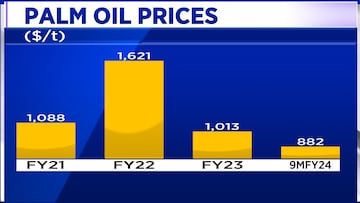

Addressing concerns over pricing fluctuations, Mallick highlighted that the prices have generally remained stable over the past several months.

He noted that while prices have increased slightly over the last 15-20 days due to supply-side constraints, primarily delays in shipments, these are temporary logistical challenges and should be resolved by mid April.

The company, which has a market capitalisation of ₹44,475 crore, has seen its shares decline 17% over the last year.

(Edited by : Shweta Mungre)

First Published: Mar 14, 2024 1:28 PM IST