ABB, the parent company of ABB India, declared its results for the second quarter of CY2023, wherein the order inflows declined 2 percent to $8,667 mn versus $8,807 mn year on year.

Two out of four business areas recorded single digit order growth, with Process Automation declining due to portfolio changes and Robotics and Discrete Automation down from last year's level which benefited from pre-buys in a period of significant component shortages.

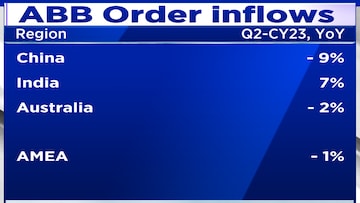

Order intake in Asia, Middle East and Africa declined as the positive development in countries like India and Saudi Arabia did not offset declines in other countries such as China.

Automotive remained broadly stable while the general industry and consumer-related robotics segments declined. In transport & infrastructure, there were positive developments in marine & ports and renewables. In buildings there was weakness in all three regions in residential-related demand. In the commercial construction segment weakness was noted in China and Germany, while demand was solid in the US.

The revenues grew 13 percent to $8,163 mn compared with $7,251 mn. The Operational EBITA margin of 17.5 percent is up 200 basis points year on year, with all four business areas above 15 percent. This was supported by a strong price contribution which more than offset labor inflation as well as some limited cost inflation related to commodities, with additional support from operational leverage on increased volumes in production.

ABB closed the divestment of the Power Conversion division at around $500 million. As a result, it expects to record a non-operational book gain estimated at approximately $50 million in income from operations in the third quarter of CY2023.

ABB, in the third quarter of CY2023, anticipates a low double digit comparable revenue growth and the Operational EBITA margin to be slightly up from the 16.6 percent reported in the third quarter last year. For the full-year 2023, despite current market uncertainty, ABB anticipates comparable revenue growth to be at least 10 percent and Operational EBITA margin to be above 16 percent.

At 11 am on July 20, ABB India declines nearly 8 percent, while peers - Cummins and Siemens are trading 1 to 3 percent lower on NSE.

ABB India shall declare its June quarter results on August 11, while Cummins shall declare on August 3.

First Published: Jul 20, 2023 11:33 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM