After the price of jet fuel in Delhi was reduced for the first time this year shares of domestic airlines – IndiGo and SpiceJet – moved in different directions on Wednesday.

The Indian Oil Corporation (IOCL) cut the price of Aviation Turbine Fuel (ATF) by 1.3 percent to Rs 1.21 lakh per kilolitre. In Mumbai, the prices touched Rs 120,306.99 kilo per litre and in Chennai, it cost Rs 125,725.36 per kilolitre.

These prices are still much higher than the levels in January, and therefore whether the cut will lead to reduced airfares remains to be seen. After a series of nine recent hikes, jet fuel which makes up for almost 40 percent of the running cost of an airline had surged to an all-time high in 2022.

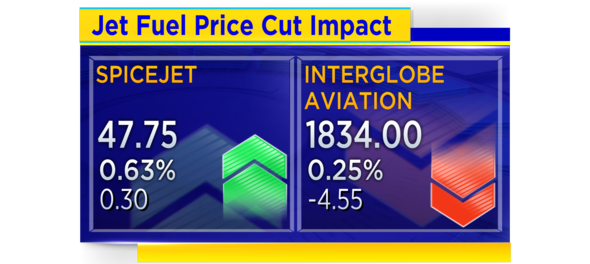

Following the reduction in ATF cost, shares of InterGlobe Aviation — IndiGo's parent firm — rose 2.2 percent in intraday trade but gave up the gains and fell 2.7 percent from the highest level of the day to Rs 1,828.60 on BSE. At 1:25 pm, the stock was trading at Rs 1,828.35, down 0.5 percent from its previous close.

Spicejet shares, on the other hand, cheered the rate cut and jumped 2 percent during the day and were trading half a percent higher at Rs 47.75 on BSE at 1:25 pm.

Also Read: View | All is not well with Indian aviation

According to Deven Choksey of K R Choksey Shares & Securities, ATF remains the key factor for aviation companies and that is not in their control. On one side, the demand scenario remains extremely convincing for India as a whole though competition is coming up, the cost factor is always going to be challenging, he said.

“They (new players) are going to look at high market share to be taken over from what IndiGo is currently enjoying. The players including, the new focus Air India, could possibly be a good competition eventually,” he told CNBC-TV18.

IndiGo CEO Ronojoy "Rono" Dutta, meanwhile, has said, the demand for air travel has become stronger than pre-COVID. Just a day before the ATF price cut, Dutta told CNBC-TV18, “We are on the cusp of profitability... need a little bit of help on the cost side. We have a glimmer of hope; a lot depends on crude oil prices… Oil prices need to behave.”

He said the airline was witnessing more passengers travelling more frequently, leading to a 5-6 percent monthly growth in revenue.

Meanwhile, earlier in May, ICRA said domestic air passenger traffic is estimated to have logged an 83 percent growth year-on-year at 10.5-million in April as COVID-19 infection cases waned, leaving a gap of just 5 percent when compared to the pre-pandemic level.

First Published: Jun 1, 2022 2:33 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM