IndiGo, India’s largest airline by fleet and market share, created ripples even before launch. Its announcement of 100 aircraft was unheard of for Indian aviation in 2006. Not only did the airline take delivery of all of those, but it also took them on schedule, again a rarity in Indian aviation.

In 2011, the airline placed an order for 180 A320 aircraft comprising 30 A320ceo and 150 A320neo. By 2014, when the airline received the 100th aircraft from its initial order, it had already placed another order for 250 A320neo aircraft. Having converted the 30 A320ceo to A320neo, the airline was hoping to get delivery of its aircraft to replace the older A320ceo and have a rapid induction in fleet.

However, that was not the case to be. Airbus was struggling to meet deadlines and the A320neo eventually entered service with IndiGo in 2016. The impeccable fleet planning strategy was dented – for no fault of the airline. Inducting a new aircraft, returning them to lessor after 6 years of service to avoid expenditure on expensive maintenance checks later and keeping the fleet young was the core philosophy for the airline.

The delay from Airbus in delivering the A320neo and issues with the Pratt & Whitney engines since the deliveries started has led to the airline look for ways to fill the capacity void. This included extending lease of existing aircraft and leasing aircraft from market. This meant the airline has a fleet of multiple engine types putting some strain on the maintenance and costs and aircraft older than 6 years are still with the airline.

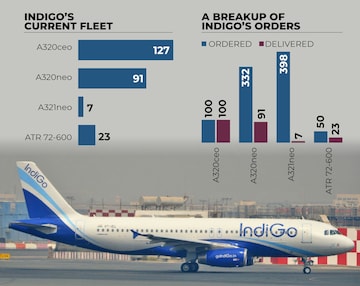

Against this backdrop, the airline placed an order of 300 A320neo family aircraft. The split, as declared by Airbus, shows the airline having ordered 87 A320neo and 213 A321neo as part of the recent order. Some of these 213 aircraft will be the A321XLR. With the latest order, the airline has placed an order for 830 aircraft with Airbus and 198 of those are delivered. The airline will take delivery of 241 A320neo and 391 A321neo in the coming years. The airline also has 27 ATR72-600 aircraft on order, with 23 already in fleet.

The move towards the A321

As of today, 62 percent of the airline’s pending order with Airbus is for the A321neo. What made IndiGo move towards the A321neo?

low-cost carriers by balancing the higher CASK of ATRs with the lower ones of A321neo.

Indian aviation is characterised by low fares, high costs, infrastructure constraints and cut-throat competition. Most of these are not in control of the airlines and hence, a move towards the A321neo helps the airline tackle high costs and infrastructure constraints to some extent in one go.

What next?

The airline this year said that it won’t add any more A320ceo but stick to the A320neos. A lot has changed in the last few days. A recent diktat from DGCA to replace engines and supply chain issues at Hamburg plant of Airbus, could push the airline to rethink this strategy. Businesses in general and aviation business in particular have rarely been able to follow a strategic plan without changes and in most cases like this one, due to external factors.

While airlines get discounts at list prices, it is unlikely that the A321neo would be available at the rate at which the A320neo would be available post discounts. The airline will have to fill up the incremental seats at incremental rates since the current levels have not been sustainable, going by the results the airline declared last quarter.

The airline currently has 127 A320ceo in its fleet and 91 A320neo. The 241 A320neo on order will be replacement for the 127 A320ceo and the initial lot of A320neos while the A321neos will form the incremental fleet and capacity. With the flexibility to convert the A321neos to A321XLR or have differential seating plan, ranging from current 222 to the maximum 240 – there is a lot that the airline can play around with going forward!

Ameya Joshi is the founder of aviation analysis blog NetworkThoughts.

First Published: Nov 26, 2019 9:00 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Pallavi Dempo, Jyotiraditya Scindia among richest candidates in third phase

May 2, 2024 2:50 PM

Bengali star Dev files nomination, promises to plant trees equal to number of votes he gets

May 2, 2024 2:27 PM