Today is a big day for the Wadia group-backed grounded airline GoFirst, its lenders and other stakeholders. Bids for GoFirst will be opened today, February 23, as the grounded airline’s lenders and the committee of creditors are all set to meet today to review the bids. Currently, there are two entities interested in acquiring GoFirst. Ajay Singh along with EaseMyTrip’s Nishant Pitti through Busybee Airways is the first suitor and the other is Sharjah-based Sky One.

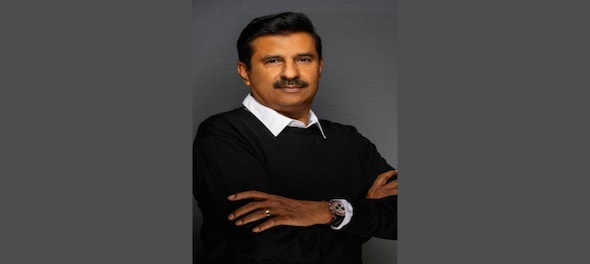

CNBC-TV18 exclusively caught up with Jaideep Mirchandani, Chairman of Sky One FZE on the company's plans to acquire GoFirst.

What is the bid amount?

The bidding process is set by the RP and we don't plan to bid via the media. Please respect the process in place, once complete - we would be happy to share all the information.

GoFirst owes over ₹10,300 crore to operational and financial creditors. How do you plan to sort out the finances?

At this time, we have shared a detailed plan with the RP and we would be happy to make it public once the bid is (hopefully) approved.

What exactly is your turnaround plan for GoFirst?

SkyOne has extensive experience in incubating, transforming and setting up airline start-ups. In the last 12 months, we have done this for two passenger and two cargo airlines - so our experience is in sync with what Go First needs. While Air Charter and MRO are strong suits for us, it is our ability to read the market requirements and a company’s strength and we are hopeful of doing the same again.

How do you plan to negotiate with lessors considering all of them have submitted a deregistration request with DGCA?

It is premature to comment on the operational aspect of a company that we have just submitted a bid for. However, since lessor negotiations are the most important part of this equation, and because we have a good working network amongst the lessors, we plan on reaching out to them as soon as the bid is (hopefully) approved.

If Sky One gets GoFirst under its wings, how soon would you want to start operations? With how many aircraft are you planning to start operating?

It is premature to comment on the operational aspect of a company that we have just submitted a bid for. At this time, we have shared a detailed plan with the RP and we’d be happy to make it public once the bid is (hopefully) approved.

Do you plan to invest more in your personal capacity? If yes then how much?

Sky One is always considering investment, especially in the Indian Aviation sector. However, it is premature to comment on ongoing plans.

Would you be raising funds? If yes then how?

At this point, Sky One is confident of its bid. If a requisition of fundraising comes across, we will consider it at that stage.

How do you plan to rebuild confidence in staff, vendors, passengers, govt etc?

We have a team of experts who will be working very closely with all the stakeholders to ensure that all their concerns are addressed and that their confidence is reinstated. We are confident that with our experience and strategy, we will be able to re-establish GoFirst as a successful and sustainable airline.

The Pratt and Whitney engine issue is a global issue, how do you plan to tackle this?

Unfortunately, the engine issue is something that is likely to persist in the industry for the next couple of years. The shortage of engines due to production halts during COVID are now catching up with the industry, especially since the passenger numbers are on the increase due to the economic growth in India. As to how we will tackle it - We have shared a detailed plan with the RP and we’d be happy to make it public once the bid is (hopefully) approved.

(Edited by : Asmita Pant)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM