IndiGo, India’s largest airline by fleet and domestic market share, has made no secret of its international ambitions. From expressing interest in the widebody operations of Air India to launching flights to Istanbul and code sharing with Turkish Airlines, the airline has been aggressively trying to fill in the space that existed even when Jet Airways was in operation. Ronojoy Dutta, the airline’s CEO, made some interesting comments about international operations during an interview with CNBC-TV18.

With Jet Airways as good as gone after the suspension of services on April 17, there is a void which needs to be filled. IndiGo seems to be willing to do it, albeit conditionally. The conditions are internal and driven by focus on profitability, going by the interview of the CEO, which bode well for the shareholders of the company.

At its peak, Jet Airways had more than 50 percent of its revenues generated by international operations. However, Jet operated wide-body aircraft which deploy far higher capacity in Available Seat Kilometers (ASKs) than the narrow-body aircraft that IndiGo uses to operate in shorter sectors.

In the case of IndiGo, lack of widebody (just yet) means that its capacity by ASK per flight is far lesser than what Jet Airways had for its flights to London, Hong Kong and Amsterdam. ASK is a function of the number of seats available and the distance travelled, and on both counts, IndiGo isn’t comparable.

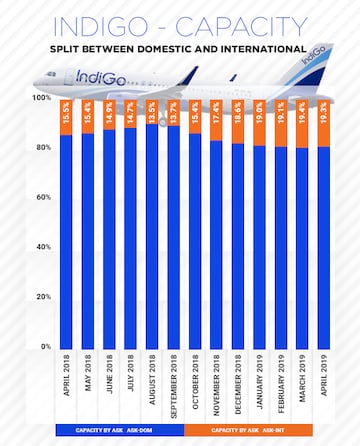

While the airline does not bifurcate the domestic and international revenue, the Directorate General of Civil Aviation (DGCA) does give out the split between domestic and international traffic. The data released by DGCA shows how IndiGo has been inching closer to deploying 20 percent of its total capacity on International routes, with March 2019 having seen the highest at 19.4 percent. Data for May have not yet been released by the aviation regulator.

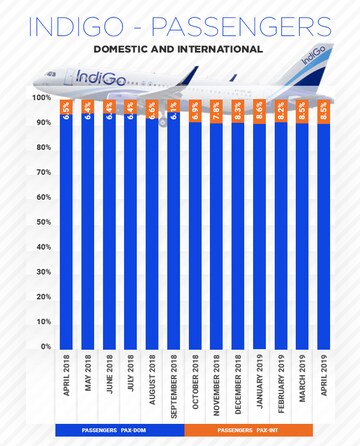

While the capacity has risen — flight by flight literally — it hasn’t translated into a corresponding share of passengers. Just 8.5 percent of the total passengers carried by the airline was on international routes while a whopping 91.5 percent passengers which the airline carries are on its domestic routes where the airline holds close to 50 percent of the market share.

Percentages can hide more than what they reveal at times. The airline carried 187, 083 more passengers on international routes in April 2019 compared with the same month last year. The same comparison on the domestic side and you know the massive scale of IndiGo on domestic routes in India. The airline carried 901,172 additional passengers than April 2018 and carried a total of 5,481,088 domestic passengers in April 2019.

The airline has specified that its focus is international and will see a large percentage of its new routes and expansion being driven on international routes. International routes have benefits like cheaper fuel and earnings in dollars, which help offset some of the huge US currency-denominated costs of airlines like leasing costs. However, these benefits may not be enough since the longer flights also come with higher trip costs and distribution challenges.

The next few quarters will see a clearer plan from IndiGo and more codeshare agreements (an arrangement in which two or more airlines market and fly the same flight under their own airline designator and flight number). Jet Airways had codeshares to support its large international network and for IndiGo to grow from metros and Tier II cities, it will require a large and aspirational middle class in the country to make higher spends and fly abroad, in addition to the codeshares with more airlines on the west and a few on the east. Its current codeshare with Turkish airlines has so far given access to only 12 destinations, while the plan was for 20. The restricted bilateral means that there can only be two destinations from India which it can connect to Istanbul and the airline has chosen only one.

Codeshares give traffic, they may or may not give the revenue that is necessary to sustain a route and to avoid the mistakes of Jet Airways as the CEO rightly pointed out in the interview, it is important to look at how sustainable the flights are, by revenue – when everybody else has been focusing on traffic!

Ameya Joshi is the founder of aviation analysis blog NetworkThoughts.

Read Ameya Joshi's columns here

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 35% voter turnout recorded by 1 pm

Apr 26, 2024 9:11 AM