The prices of nickel have soared to above $100,000 per metric tonne as Russia’s invasion of Ukraine threatens to unravel supply chains in a world that has barely started to recover to pre-pandemic levels of economic activity. For electric vehicle manufacturers, the increased input costs threaten to slump productions and make vehicles unaffordable for consumers.

Russia is one of the top producers of nickel and other metals like aluminium, palladium and more that are needed in the production of EVs. In the face of the multinational sanctions on Russia, and Russia’s restrictions on exports of raw material, prices of these commodities have been soaring.

The London Metal Exchange (LME) suspended trading for nickel after future contracts for the metal more than doubled to $100,000 a tonne. Buyers tried to secure supplies amid increased fears of nickel shortages in the near future.

“As of this writing, nickel is up 67.2% just today, representing around a $1,000 increase in the input cost of an average EV in the U.S,” wrote Morgan Stanley auto analyst in a note.

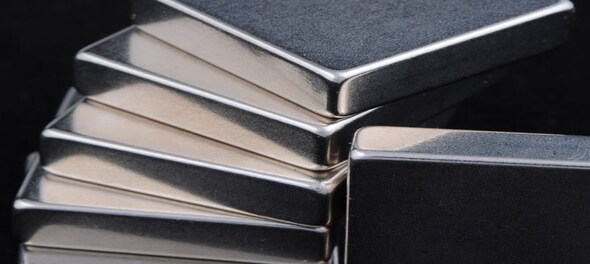

Nickel is a key component in lithium-ion batteries that are used in EVs. The introduction of the metal to the cathode of the battery increases the energy density of the batteries, resulting in more range per weight, which is an important factor for many EV buyers.

Many OEMs are already using batteries which use cathodes that are made up of around 60 percent nickel but some have even higher nickel concentrations. Tesla’s batteries supplied by LG Chem have 90 percent nickel cathodes.

This increased price may be the reason that the EV penetration across global markets may slow down despite government subsidies and incentives. EV adoption had been slowly seeing an uptick as automobile OEMs unveiled ambitious plans for EVs.

But OEMs that have been experimenting with other battery technology, like lithium iron phosphate, or LFP, aren’t as dependent on nickel supplies and prices. But while LFP costs much less than lithium-ion batteries, its energy density is also much lower. For cheaper models, that’s not much of a concern, but for premium EVs, where the range and performance (which is dependent on weight) become a selling point, LFP batteries may not be suitable alternatives.

“Price action in the nickel market overnight suggests a sense of panic and the squeeze on commodity supplies is going nowhere soon,” Jeffrey Halley, Senior Market Analyst at Oanda, told Barron’s.

Russia is responsible for producing 7 percent of the world’s premium-grade nickel, though Indonesia, Phillipines and New Caledonia are the world’s top producers of nickel, producing over 1.3 million tonnes of the metal combined.