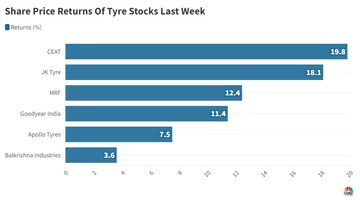

Tyre stocks were the outperformers of last week with most of the stocks gaining anywhere between 7-20 percent.

Ceat and JK Tyre were the top performers among tyre companies, while stocks like MRF and Goodyear India also saw healthy gains. The stocks comfortably outperformed the benchmark Nifty 50 index, which was flat last week, as well as the Nifty Auto index, which gained 2 percent.

Courtesy these gains seen over the last week, three of the six tyre companies are at a 52-week high. MRF is at a record high and is approaching the Rs 1 lakh per share mark, while stocks like Apollo and Goodyear India are at a 52-week high. JK Tyre is just 4 percent away from a 52-week high as well.

While stocks like JK Tyre have been gaining for nine sessions in a row, a trigger that further aided sentiment across companies were results from MRF last Wednesday.

The company's net profit doubled during the March quarter and EBITDA margin also expanded by over 400 basis points led by lower raw material costs and operating leverage.

MRF also declared its highest-ever dividend of Rs 169, taking the total payout for financial year 2023 to Rs 175.

"Tyre stocks are in a sweet spot," Mayuresh Joshi of William O'Neil India told CNBC-TV18 last week. "The Rs 169 dividend announced by MRF has a lot of people watching out for it and has a role to play in the excitement surrounding these stocks."

Joshi further said that stocks like Apollo Tyres will continue to do well if they deliver in their quarterly results.

The street expected stronger results from other tyre companies post MRF's results and Ceat did not disappoint on Thursday.

The company reported healthy volume growth sequentially as well as on a year-on-year basis with exports showing early signs of recovery. Margin expansion of 553 basis points was led by operational efficiencies and reduction in raw material costs.

Ceat's raw material basket cost has reduced by 8-9 percent over the December quarter. The company also managed to reduce debt by 10.5 percent sequentially.

"Ceat again post these strong numbers there is still room for strong growth, margins to sustain at current levels, which should provide further upside," Siddhartha Khemka of Motilal Oswal said.

Although prices of rubber, a key input fell during the January-March period, they were at a six-and-a-half-week high towards the end of April.

Ravi Budhraja, DG of Automotive Tyre Manufacturers' Association told CNBC-TV18 on April 26 that the global production of rubber this year is likely to be at 8 lakh tonnes this year, while consumption may cross 15 lakh tonnes.

The international rubber consortium has further mentioned that supply of rubber will remain tight in the first half of 2023.

India is the second largest consumer of Natural Rubber in the world, where 71 percent of the consumption in the tyres and tubes sector.

Total vehicle retail sales for the month of April were down 4 percent year-on-year, indicating a slow start to the new financial year. However, sales of Commercial Vehicles and three-wheelers were up year-on-year.

The Federation of Automobile Dealers Association believes that the upcoming marriage season in May will bring about a resurgence in sales, driven by increased customer enquiries. FADA also said that the CV segment is witnessing strong demand. Rising automobile sales may lead to a boost in tyre demand.

"The overall outlook on the tyres is turning out to be positive, because of several reasons," Motilal's Khemka said, attributing the upside to better supply chain, falling raw material prices and improved semiconductor availability. He further said that some of the stocks are no longer cheap considering the recent run-up.

"But if you look at the overall space, as I said, I think we still believe that there is room for further upside," he said.

Also Read: MRF declares dividend of Rs 169 post March quarter earnings, net profit doubles from last year

First Published: May 8, 2023 5:25 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh: Kuppam loyalty test for TDP chief Chandrababu Naidu

May 6, 2024 9:35 AM

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM