Bajaj Auto's electric scooter, Chetak, now holds an 11% market share, the company's Executive Director, Rakesh Sharma told CNBC-TV18.

"Our market share has increased from 4% at the end of FY23 to 11% in September. This growth is due to improved availability, better pricing, and our ability to restructure our product costs."

Chetak's success reminds us of a phrase by Rajiv Bajaj, Bajaj Auto's Managing Director, from two years ago: "Champions eat OATS for breakfast." Made during the Pulsar 250 launch in October 2021, "OATS" referred to rising EV startups like Ola Electric, Ather Energy, Tork Motors, and SmartE.

Also Read:

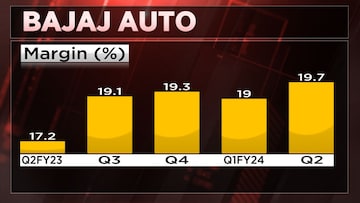

Sharma attributed the improvement in second-quarter margins to a better product mix with increased contribution from premium bikes. Bajaj Auto's margin for the second quarter of the financial year jumped 260 basis points year-on-year to 19.7%.

"The mix has really improved in favour of the premium motorcycles in the domestic business, a surging three-wheeler business, and because of some exchange rate improvements, realisation improvements between Q2 of last year and this year.."

Bajaj Auto's domestic business sees a 65% contribution from premium motorcycles (above 125cc), surpassing the industry average of 50%, highlighted Sharma.

Bajaj Auto, on October 18, reported a 20% year-on-year (YoY) rise in net profit for the September quarter at Rs 1,836.14 crore. It was Rs 1,530 crore in the year-ago quarter. The profit figure was much higher than CNBC-TV18's poll of Rs 1,752 crore.

The earnings before interest, taxes, depreciation and amortization (EBITDA) came in at Rs 2,133 crore. The quarterly EBITDA surpasses the Rs 2,000 crore milestone for the first time, growth of 21% YoY.

Shares of Bajaj Auto were trading 4% higher at Rs 5,363. The stock has gained more than 3% over the past month.

(Edited by : Shweta Mungre)

First Published: Oct 19, 2023 11:42 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM