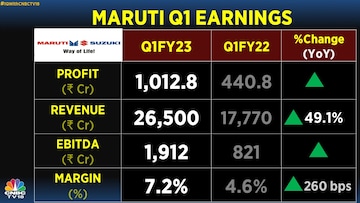

Maruti Suzuki's quarterly revenue exceeded Street estimates, but higher raw material prices — thanks to a sustained increase in commodities — and a prolonged shortage of semiconductors dented its operating performance. The net profit of India's largest carmaker more than doubled compared with the corresponding period a year ago — analysts had expected a 3.5 times jump.

Maruti Suzuki shares slipped into the red in a broadly strong session on Dalal Street.

Analysts in a CNBC-TV18 poll had pegged Maruti Suzuki's quarterly net profit at Rs 1,540 crore.

Maruti Suzuki said the numbers are not comparable on a year-on-year basis due to COVID-related shutdowns and disruptions in the quarter ended June 2021.

The Street has mixed views on Maruti's set of earnings, though some analysts see an upside of almost 10 percent in the stock compared with Wednesday's closing price.

"Everything remains very positive, but then execution is what you need to watch very closely. I would not jump on it just because of this optimism... There's a lot of hope that's riding in rather than numbers that tell you that things are very great as of now," market expert Prakash Diwan told CNBC-TV18.

BofA Securities maintained a 'buy' call on Maruti Suzuki after the auto major's earnings announcement, with a target price of Rs 9,500 apiece.

The brokerage is of the view that the management's comments on demand and new models are positive and the risk-reward skewed towards the positive zone for the carmaker.

However, other analysts are not so convinced.

CLSA said Maruti Suzuki's success in SUVs is still not proven.

CLSA continued with a 'sell' call on Maruti Suzuki though it did raise its target price by 4.6 percent to Rs 7,374. The auto maker's EBITDA margin fell short of the brokerage's expectations, on account of pressure emanating from raw material costs.

Maruti's EBITDA margin though rose by 260 bps to 7.2 percent for the three-month period, it fell short of the expectation of 8.6 percent by analysts in the CNBC-TV18 poll.

EBITDA margin is a key measure of a business's operating profitability. It determines earnings as a percentage of its total sales before taking into account the impact of components such as taxes and interest.

According to Nomura, an industry slowdown in the year ending March 2024 is a key risk, though the ramp-up of new SUVs and margin tailwinds can be viewed as key positives.

The brokerage expects Maruti Suzuki to clock growth of 25 percent and five percent in the years ending March 2023 and March 2024 on a lower base respectively.

A key risk for the company for the next two years continues to be a faster shift to electric vehicles, according to Nomura, which has a 'neutral' rating on the stock with a target price of Rs 8,970.

(Edited by : Sandeep Singh)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM