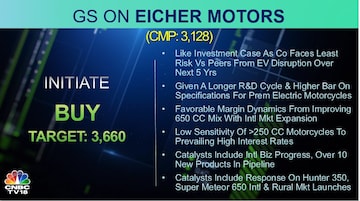

Following a 12 percent stock price correction since November 2022, due to cannibalization concerns from the Hunter 350 model launch and high volume base in larger towns, Goldman Sachs believe the market is underestimating the upside opportunity on Eicher Motors. This auto player is the owner of the Royal Enfield premium motorcycle brand.

Goldman Sachs further adds that Eicher Motors faces the least risk versus its peers from Electric Vehicle (EV) disruption over the next 5 years, given a longer research and development cycle and higher bar on specifications for premium electric motorcycles. The brokerage also views the auto player as having favorable margin dynamics from improving 650cc mix with international market expansion and low sensitivity of 250cc+ motorcycles to prevailing high interest rates.

Goldman Sachs in its initiating coverage note has a Buy rating with a 12 months target price of Rs 3,660. At 10:30am today, stock trades at Rs 3,191 gaining 2 percent since start of the session, while it has rallied 8 percent in the past 5 days.

On the contrary, earlier this week

Macquarie downgraded the stock to Rs 3,258 on the back of lower volumes and margins. It expects a slower earnings growth outlook of 13 percent for FY23 to 25 earnings CAGR versus company's history of 35 percent CAGR delivered over FY14 to 19 delivered.

Eicher Motors had earlier announced a

price hike of 2 to 5 percent due to new BS6 regulations and inflationary pressure. The implementation of these regulations has required significant investment by automakers in research and development to develop new engines and technologies that meet the new standards.