Castrol India board is actively in discussion with the parent company to reward shareholders, said CFO and Whole-Time Director Deepesh Baxi, on Wednesday.

“We are in active conversation on how best to reward our shareholders on a short-term basis and on a long-term basis. As soon as we get something more concrete, we will be able to share with everyone," Baxi said in an interview with CNBC-TV18.

He added that there is no better return than showing growth in market share and that is exactly what the company is working on.

Castrol India said it has a strategy in place to future-proof the business and is aggressively working on that. From the financial engineering point of view, various options are being considered in which the company can return the cash to the shareholders after it deploys for organic or inorganic growth.

“One such initiative has been to increase the interim dividend by 25 percent compared to the last year’s interim dividend as well,” said the CFO.

Castrol India owns about 20 percent of the overall Indian lubricant market and the company sees enough growth in the next 20 years.

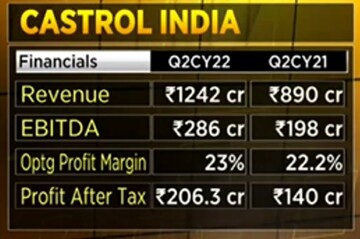

The company reported a strong volume growth for the second quarter of calendar year 2022 with a 24 percent year-over-year (YoY) jump, which led to strong revenue growth of 40 percent and steady margins at around 23 percent. However, the higher expenses have hit the earnings sequentially on rising input costs both in terms of crude and base oil.

“We made sure that we pass on the price increases in a strategic manner,” said Baxi.

“The demand is looking very good and we will be able to maintain the momentum that we have and we want to grow double the market growth rate. Looking at the situation right now, apart from the headwinds that we are facing on the crude oil and some of the base oil inputs, volume focus is there and we should be able to deliver in line with what our plans are,” he explained.

The stock was trading slightly lower by 0.13 percent at Rs 115 per share on BSE at the time of writing. It is up 9.49 percent in the past month.

For the entire discussion, watch the accompanying video